- Home

- >

- Commodities Daily Forecasts

- >

- Venezuela and Libya out of OPEC while US increases yield, what’s next for WTI?

Venezuela and Libya out of OPEC while US increases yield, what's next for WTI?

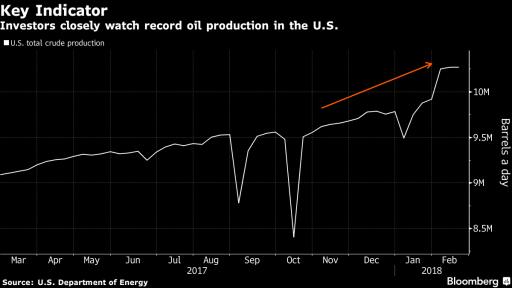

Oil is headed for its first monthly decline in six months, all against the backdrop of major efforts by OPEC and cartel allies like Russia (OPEC +). The main reason for OPEC +, mistakes remains the surging US oil shipment. WTI futures declined by 3.1% in February, mainly due to the rise in US oil reserves and the country's rising exports. Later today, at 17:30, we expect the weekly US oil inventories, with investors expecting to jump for a fifth consecutive week, this time at 2.40m. barrels.

What will move the oil next month?

What OPEC has to do with shale oil producers next week is what the traders should watch out for. The meeting will take place in Houston, while the US Department of Energy is expected to record a record shale oil production that seriously threatens the cartel's efforts to balance the market.

Next month, there will also be two events that will also help Short-ae in oil. The members of OPEC, Venezuela and Libya are on the way to reversing the deal. The Venezuelan economy is hit by hyper-inflation, driven mainly by the fall in oil and the government's inability to restructure its economy. On the other hand, Libya is about to replenish its exports, as a key port in the country will be "modified" after the mass protests that led to its closure and a significant drop in oil exports.

In addition, if we look beyond OPEC and US production, USD would also have an impact, but more limited. Since oil is denominated in US dollars and investors' expectations are USD to grow, the negative picture of black gold is complete.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.