- Home

- >

- Commodities Daily Forecasts

- >

- Oil, geopolitical risks, could push prices higher

Oil, geopolitical risks, could push prices higher

The loss of Iranian crude to the market – amid U.S. sanctions on the Islamic Republic, which get underway in November – is seen by many as the biggest risk to global supplies. Analysts have estimated up to 1 million barrels a day of Iranian crude could be wiped of the market.

U.S. President Donald Trump in May said the United States would leave the 2015 Iran nuclear agreement, paving the way for sanctions to resume.

Iran’s leader warned over the weekend that it might shut the Strait of Hormuz, the world’s most important seaborne transit lane for oil.

In addition, oil prices get fresh boost after data from the American Petroleum Institute (API) reported U.S. crude inventories fell more than expected last week.

U.S. crude stockpiles fell 3.2 million barrels in the week to July 20, the API said on Tuesday, compared with expectations for a decrease of 2.3 million barrels.

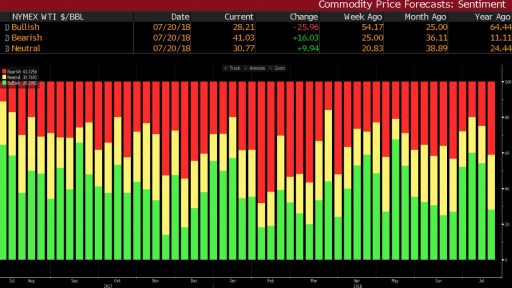

However, graph shows that for now the bears prevails, which means that the markets doesn't judge the

price, so critical.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.