- Home

- >

- Commodities Daily Forecasts

- >

- Oil prices slide after IEA casts doubt over demand outlook

Oil prices slide after IEA casts doubt over demand outlook

Oil prices fell more than 1 percent on Wednesday, continuing Tuesday's slide after the International Energy Agency cast doubts over the past few months' narrative of tightening fuel markets.

Brent crude futures (LCOc1) were at $61.33 per barrel at 0515 GMT, down 88 cents, or 1.4 percent from their last close.

U.S. West Texas Intermediate (WTI) crude (CLc1) was at $55 per barrel, down 70 cents, or 1.3 percent.

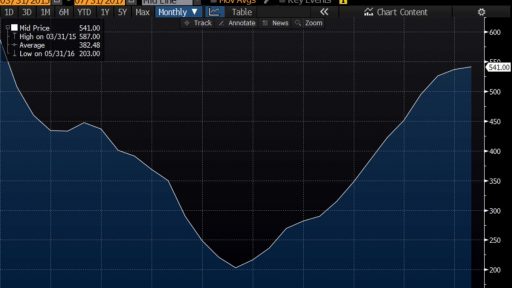

The price falls mean that crude prices are now down by around 5 percent since hitting 2015 highs last week, ending a 40-percent rally between June and early November.

"Crude prices dropped dramatically after the IEA forecast a gloomy outlook for the near future ... The drop was arguably exacerbated by a global selloff in other commodities," said Sukrit Vijayakar, director of energy consultancy Trifecta.

The International Energy Agency (IEA) on Tuesday cut its oil demand growth forecast by 100,000 barrels per day (bpd) for this year and next, to an estimated 1.5 million bpd in 2017 and 1.3 million bpd in 2018.

"The oil market faces a difficult challenge in 1Q18 with supply expected to exceed demand by 600,000 bpd followed by another, smaller, surplus of 200,000 bpd in 2Q18," the agency said.

The demand slowdown could mean world oil consumption may not, as many expect, breach 100 million bpd next year, while supplies are likely to exceed that level.

The IEA report countered the Organization of the Petroleum Exporting Countries, which just a day earlier said 2018 would see a strong rise in oil demand.

Vijayakar said a reported increase in U.S. crude inventories was also weighing on prices.

The American Petroleum Institute (API) said on Tuesday that U.S. crude inventories rose by 6.5 million barrels in the week to Nov. 10 to 461.8 million.

U.S. government inventory data is due later on Wednesday.

On the supply side, rising U.S. output also pressured prices.

U.S. oil production has already increased by more than 14 percent since mid-2016 to 9.62 million bpd and is expected to grow further.

The IEA said non-OPEC production will add 1.4 million bpd of additional production in 2018.

The IEA's outlook pressures OPEC to keep restraining output in order to defend crude prices, which its members rely on for revenue.

OPEC and some non-OPEC producers including Russia have been withholding production this year to end years of oversupply.

The deal expires in March 2018 but OPEC will meet on Nov. 30 to discuss policy, and it is expected to agree an extension of the cuts.

"Anything less than a full nine-month extension delivered at the Nov. 30 meeting could precipitate a sell-off," U.S. bank Citi said.

OPEC raised its forecast on Monday for demand for its oil in 2018 and said its deal with other producers to cut output was reducing excess oil in storage, potentially pushing the global market into a larger deficit next year.

The Organization of the Petroleum Exporting Countries also said in a monthly report it had cut its estimate of 2018 supply from non-OPEC producers and said oil use would grow faster than previously thought due to a stronger-than-expected world economy.

"The global economic growth dynamic has continued its broad-based and relatively strong momentum," OPEC said. "The ongoing momentum could still provide some slight upside potential."

OPEC said the world would need 33.42 million barrels per day (bpd) of OPEC crude next year, up 360,000 bpd from its previous forecast and marking the fourth consecutive monthly increase in the projection from its first estimate made in July.

The report is OPEC's last before a Nov. 30 meeting in which the group and its allies are expected to extend their supply-cutting deal further into next year. The projections pointing to a growing 2018 supply deficit could influence debate on how long to maintain the curbs.

Oil prices, which are close to their highest since 2015, rose further towards $64 a barrel after the report was issued. Crude is still about half its level of mid-2014 when a build-up of excess supply led to a price collapse.

The 14-country producer group said its oil output in October, as assessed by secondary sources, was below the 2018 demand forecast at 32.59 million bpd, a drop of about 150,000 bpd from September.

The report's OPEC production figures mean compliance with the supply cut by the 11 members with output targets has risen above 100 percent from 98 percent initially reported in September, according to a Reuters calculation.

"The high conformity levels of participating OPEC and non-OPEC producing countries ... have clearly played a key role in supporting stability in the oil market and placing it on a more sustainable path," the report said.

Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.