- Home

- >

- Daily Accents

- >

- Oil Rally Lifts Stocks as Dollar Slips With Bonds: Markets Wrap

Oil Rally Lifts Stocks as Dollar Slips With Bonds: Markets Wrap

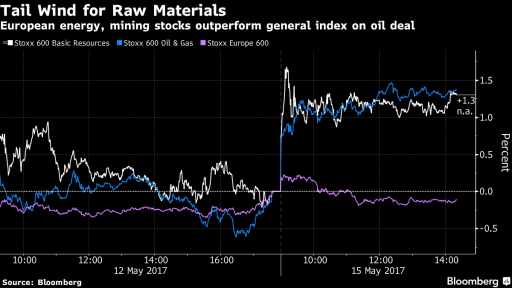

Crude rallied on the prospect a deal to cut global supply will be extended, leading a broader advance across commodities and spurring the currencies of major exporters. U.S. stocks advanced, while the dollar retreated

West Texas Intermediate jumped more than 3 percent after Saudi Arabia and Russia said they’d extend a production-cut deal longer than expected. The Australian and Canadian dollars, South African rand and Mexican peso were among the best performing major currencies. The S&P 500 Index edged higher, while emerging-market equities gained a sixth day.

And here are the main movers:

Stocks

- The S&P 500 Index rose 0.2 to 2,396.37 as of 9:32 a.m. in New York. It ended last week down 0.4 percent, its first loss since mid-April

- The Stoxx Europe 600 retreated 0.2 percent as of 9:05 a.m. in New York, after touching the highest level since August 2015 last week.

Commodities

- WTI jumped 3.5 percent to $49.54 a barrel, after climbing 3.5 percent last week.

- Gold rose 0.6 percent to $1,235.43 an ounce, extending gains to a third day.

- Copper increased 1.2 percent while aluminum rose 1 percent. Zinc added 1 percent after a three-day slide.

Currencies

- The Bloomberg Dollar Spot Index slipped 0.4 percent after falling 0.4 percent Friday. The yen was little changed, and the euro added 0.4 percent to $1.0970.

- The Australian and Canadian dollars strengthened 0.8 percent and the Mexican peso 0.9 percent, while South Africa’s rand gained 1.4 percent.

Bonds

- The yield on 10-year Treasury notes rose one basis point to 2.34 percent, after dropping six points Friday when the weaker-than-expected CPI report buoyed bond prices.

- Benchmark yields in France rose three basis points and those in Germany climbed two basis points.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.