- Home

- >

- FX Daily Forecasts

- >

- Dollar Threatens Key Technical Support as Election Gain Fizzles

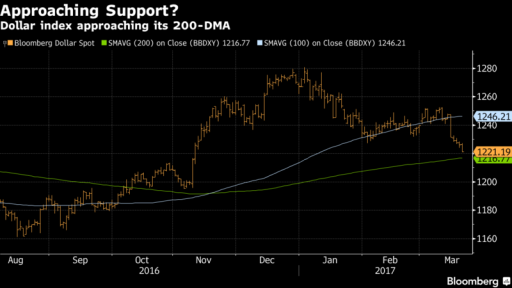

Dollar Threatens Key Technical Support as Election Gain Fizzles

The foreign-exchange market split thematically Tuesday, developing a more optimistic view of the euro and a less positive stance toward the dollar, pushing the common currency toward a year-to-date high versus the greenback.

The euro rose against most of its G-10 peers while the dollar fell against the majority of the group to surrender all but a sliver of its gains since President Trump’s election, with prospects of U.S. fiscal stimulus potentially stalling. The Bloomberg dollar index fell as much as 0.4 percent to approach its 200-day moving average, which it hasn’t breached since October 2016.

- Euro gains were spurred by snap polls which showed centrist Emmanuel Macron as the winner of the first French presidential debate Monday, easing some anxieties about the standing of populist Marine Le Pen. That shift comes at the same time as trader focus is drawn toward the recently better growth outlook in the euro area that has lifted the region’s government bond yields just as Treasury yields deflate from recent highs.

- While stale USD long positioning has mostly washed out, only a few players have set dollar shorts, leaving some potential for further losses if a stronger bearish shift is seen, two traders in London said. Near-term risks to the dollar’s well-being are seen looming Thursday when the House is set to consider the Trump health care bill and Fed Chair Yellen speaks at a conference in Washington.

- USD/JPY has slipped to a fresh session low at 111.69, lowest since Feb. 28; this pair is seen as a cleaner way to express USD bearish sentiment while side-stepping euro area political risks, traders say; still, USD/JPY would get some lift via demand for EUR/JPY, the traders note; USD was also undercut as the yield on the 10Y UST fell to a fresh low for the session under 2.42%, while JPY may have also seen haven demand as stocks in the U.S. fell ~1%

- The dollar’s outlook may dim further if Yellen shows any caution about the Fed’s forecasts for two more rate hikes this year or if Congress blocks the Republican plan to overhaul health care, thereby delaying tax reform.

- Even then, the bullish dollar view may only be suspended or delayed, one of the London traders said. Political uncertainty in the euro area remains a cloud over the shared currency as market players look beyond the French presidential race to looming elections in Germany and Italy.

- EUR rose to a fresh high at 1.0819, approaching its 2017 high at 1.0829, though the path to that level is littered with offers, traders in Asia, Europe and London said; a breach of the 2017 high may ignite fresh demand from momentum-driven players, though further sellers are lined up around the EUR’s 200-DMA at 1.0891 that should offer significant technical resistance

- GBP/USD rose to a fresh high near 1.2500, propelled by above-est. inflation data and despite a caution from BOE Gov. Carney to avoid over-reacting to one data set

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.