- Home

- >

- Great Traders

- >

- One day Leon Cooperman- hedge fund manager

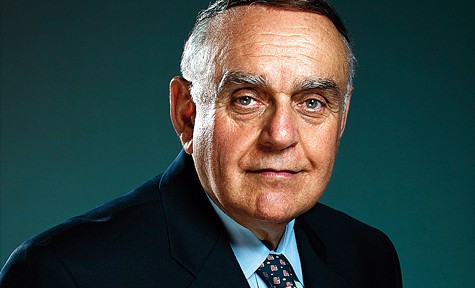

One day Leon Cooperman- hedge fund manager

Management hedge fund company for Leon Cooperman, a way of life that begins at 5:15 on weekdays, when Cooperman wakes up in Short Hills, New Jersey house, where he lived for 36 years. Then he heads to ofisa in Manhattan and its $ 10.7 billion contained in Omega Advisors. Started work at 6:30 am (he took the ferry for 30 years before the company moved from Wall Street in Midtown).

Cooperman seeks to invest 12 hours-including their working lunch in the office, bouncing among corporate leaders. Trades made in person or by phone, in consultation with its 18-member research team that iznformira and read reports of different companies. At 18: 30h. held a business dinner, most times with executives or fellow investors as Mario Gabelli- "Gamco Investors" and Bill Priest- "Epoch Investment Partners". Then take a quick shower after dinner and spent most of the time to Bloomberg, checking international markets before going to bed at 23: 00h.

"The way to develop successfully is to do what you love and love what you do," Cooperman said in an interview. "I do normally, I get a big salary for something you love to do. And what I like is to" hunt "to find something or someone else who sees and finds the right moves as security and satisfaction then" Miss Mr. Market "I proved that I was right."

The market really smiling 71-year-old billionaire Lee Cooperman. Manic approach to the selection of undervalued companies, combined with some other, has led to almost unprecedented level of return on investment for a longer time than most people have worked on Wall Street, moisture hard work and thrift.

In 2012, Cooperman made 10 recommendations in a joint conference of CNBC and some institutional investors. After them is accumulated value in the next year, well above double digits.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.