- Home

- >

- Commodities Daily Forecasts

- >

- OPEC meet 90 percent of promised cuts production

OPEC meet 90 percent of promised cuts production

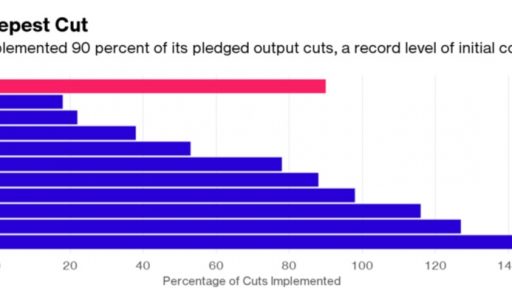

OPEC achieved the best compliance rate in its history at the outset of an accord to clear the oil glut, a plan that’s being supported by surprising strength in demand, the International Energy Agency said.

The Organization of Petroleum Exporting Countries implemented 90 percent of promised output cuts in January, the first month of its agreement, as key member Saudi Arabia reduced production by even more than it had committed, the agency said.

Resilient oil demand is aiding OPEC’s bid to re-balance world markets, growing more than expected last year and poised to do so again in 2017.

OPEC “appears to have made a solid start to what is a six- month process,” said the Paris-based IEA, which advises most of the world’s major economies on energy policy. “The first cut is certainly one of the deepest in the history of OPEC output cut initiatives.”

OPEC and Russia are leading a push by global oil producers to end a three-year oil surplus that has depressed prices and battered the economies of energy-exporting nations. While their pact initially sparked a 20 percent rally in oil prices, gains have since faltered on concern that U.S. shale drillers could revive output and undo OPEC’s efforts.

The IEA increased its 2016 estimates for world oil demand growth for a third month, and boosted its outlook for 2017, anticipating an increase of 1.4 million barrels a day this year.

World oil inventories will fall by 600,000 barrels a day during the first half of the year if OPEC sticks to its agreement, the IEA said. While stockpiles in industrialized nations have declined for five months in a row, and fell in the fourth quarter by the most in three years, they remain significantly above average levels.

While the IEA based its estimate of compliance on how much of the total cut OPEC delivered, the group also set a collective target for its members at the level needed to reduce inventories. With output rising from the two members exempt from making cuts -- Libya and Nigeria -- OPEC’s compliance with that total is only about 60 percent.

Even if those reductions are made, total supply from outside OPEC will increase by 400,000 barrels a day this year after plunging in 2016, due to gains in Brazil, Canada and the U.S. Non-OPEC nations will pump an average of 58 million barrels a day in 2017, about 100,000 a day more than predicted in last month’s report.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.