- Home

- >

- FX Daily Forecasts

- >

- Opinion: The dollar is the biggest enemy of the U.S. economy

Opinion: The dollar is the biggest enemy of the U.S. economy

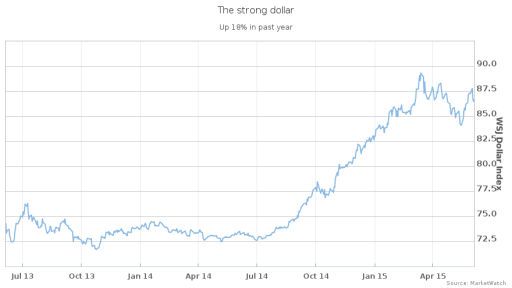

WASHINGTON (MarketWatch) — The strong dollar is killing us.

We’ve heard all kinds of valid reasons for the sharp slowdown in the economy over the past six months: the weather, the port strike, the caution of consumers, the collapse in oil-patch investments, and even something called “residual seasonality” in the statistics measuring gross domestic product.

Those (mostly temporary) factors can certainly explain a big part of why GDP went from a 5% growth pace last summer to a 0.7% contraction this winter.

But there’s something more troubling that’s missing in those pat explanations: the exchange value of the U.S. dollar BUXX, +0.01%

When the dollar gets strong, goods and services made in the USA get more expensive, and imports from foreign sources get cheaper. Manufacturers lose competitiveness. The owners’ profits suffer, workers’ wages suffer, and millions of other U.S. companies that depend on selling to those crippled businesses and workers also suffer.

The economy slows, and jobs are lost. Job growth in manufacturing, for instance, is only half as strong now as it was before the move in the dollar last summer. In May, just 7,000 manufacturing jobs were created.

Over the past year, the dollar has appreciated by about 18% against the currencies of our trading partners. That’s enough to take a full percentage point off our GDP, based on a rule-of-thumb estimated by economists at Goldman Sachs GS, +0.76%And when GDP is growing at an average of only 2.2%, that’s a serious hit.

Since the impact of the dollar began to be felt last summer, exports have fallen for the first time since the Great Recession. (Let’s not forget that weak global growth also reduced demand for U.S. exports at the same time that they became more expensive.) Meanwhile, imports are rising rapidly, despite the bottlenecks caused by the port strike.

Foreign trade has been a big negative for U.S. GDP growth in the past two quarters.

In the first three months of the year, the widening trade deficit subtracted 1.9 percentage points from GDP after subtracting 1 percentage point in the fourth quarter. That’s the biggest two-quarter drag from trade since the Asian financial crisis of 1998 and the second-largest drag since the early 1980s, when the strong dollar forced the major industrialized nations to meet at the Plaza Hotel in New York to conspire to weak it.

Roughly half of the decline in exports can be attributed to the strong dollar, according to Patrick Newport, an economist at IHS Global Insight.

The impact of a strong dollar isn’t just an idle academic exercise. U.S. companies, big and small, have been complaining about the dollar for months in their quarterly reports and in their forward guidance.The latest Beige Book was filled with comments from businesses about how the dollar was hurting their sales. So was the ISM’s survey of manufacturing executives.

In theory, a strong dollar should drive down prices, a boon to consumers and businesses that aren’t exposed to direct foreign competition, but the deflationary benefits of a stronger dollar don’t seem to be helping the economy just yet. Consumers, for instance, are putting away the money they’ve saved at the pump.

Officials at the Federal Reserve have also noticed the dollar. They usually refrain from talking about it, going along with the ridiculous tradition that only the Treasury should comment on the currency’s value, as if the Fed has nothing at all to do with it.

But lately, they’ve been expressing their concerns. In March, Fed Chairwoman Janet Yellen said “the strong dollar” was one reason that exports had softened.

In the latest redacted minutes of the Fed’s secretive meeting in April, some members of the Fed’s policy-setting Federal Open Market Committee worried that “the damping effects” of a stronger dollar “might be larger and longer-lasting than previously anticipated.”

The strong dollar complicates things for the Fed. Higher interest rates would likely strengthen the dollar further. Implicit in the Fed’s forecast for a rate hike later this year is a forecast that the economy will overcome whatever drag the dollar exerts on it.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.