- Home

- >

- Daily Accents

- >

- The European session was strong in the shadow of the trade talks

The European session was strong in the shadow of the trade talks

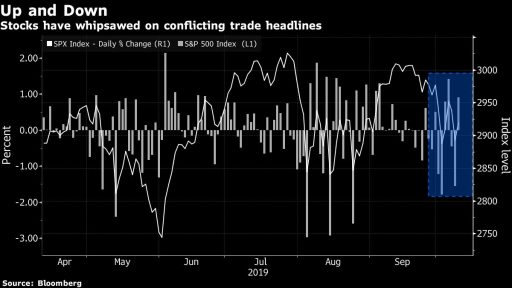

Stock markets and bond yields have pushed off their earlier bottoms and are now green. Attitudes are positive and positive, stemming from the long-awaited US-China meeting to eventually resolve the trade war. Throughout the day, we see conflicting news, which increases volatility. The GBP is up because of another positive news surrounding a potential Brexit deal.

The banking and automotive sectors led the rally at the S & P50. Additionally, Trump confirmed that negotiations will continue on Friday. The dollar depreciates, playing down weaker inflation figures. All eyes only focus on the trade war. 10-year bonds reach 1.65%.

Lastly, things are as follows: Delegations are continuing the negotiations diligently, with the Chinese remaining on Friday. The Chinese side is also ready for a partial deal, and the US is looking for a way to include the previous currency pact. China is planning to pardon one of its top shipping companies, which currently has US sanctions imposed on it to buy oil from Iran. It became clear that the Chinese buy pork from the United States in huge quantities.

Elsewhere, oil stays on the rise after OPEC Secretary General Mohammad Barkindo said all members of the organization, allies, including Russia, would "do whatever it takes" to stabilize the market amid a weakening global economy. Gold remains suppressed against risk on the backdrop, down nearly 0.10% today.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.