- Home

- >

- Daily Accents

- >

- Options are not enjoying that much of a demand, given the declines in stock markets

Options are not enjoying that much of a demand, given the declines in stock markets

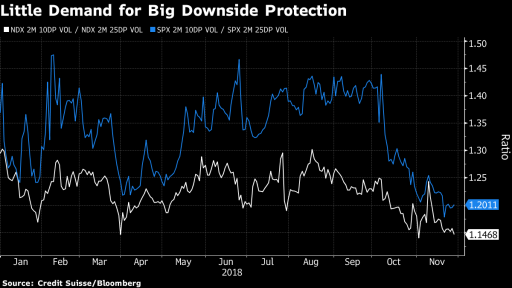

In examining share derivatives trading in the United States, there are few signs of fear, even in the tone of the two-digit rise in the S & P 500 index and the Nasdaq 100 Index.

The options that provide protection against an additional 10% drop in US base benchmarks are not very demanding. The ratio between the implicit volatility - a price proxy - 10 delta vs. 25 delta of two-month Put options, fell near the bottom of 2018.

Put / Call options at the S & P500 and their interest rate, which measures the size of the bullish against the bear's outstanding options has collapsed. This is explained by the reduction of margin indebtedness and more cautious moves instead of hedging. This is a consequence of the greater demand for Call options. There is a decreased hedge against indices with the fear index - VIX, as well as reduced demand protection for the indices. The barometer of fear that has been seen Credit Suisse has reached a five-year low. This is due to the advantage that investors have enjoyed when making more stock purchases and heightening less.

Poor search for Put options shows how strong the sale is. And it is really clear. Not surprisingly, in October we saw hedge funds at their worst levels and performances since August 2011.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.