- Home

- >

- Fundamental Analysis

- >

- Our outlook for Q4: the Fed between Scylla and Charybdis; the pressure on EM continues

Our outlook for Q4: the Fed between Scylla and Charybdis; the pressure on EM continues

In this post I build a model of the main factors that will move the dollar, and hence the world markets. This is not a prediction. This is simply a skeleton of the main factors I see as key to the economy by the end of the year.

At the end of last week, unemployment and growth in non-farm payrolls (NFP) for the United States showed a strong increase in hiring. As we described last week, the NFP is one of the most important data for the markets and the Federal Reserve: The NFP Effect on Markets. This is because rental growth is among the best leading indicators for GDP.

These are not the only positive data from the United States. Productivity of the workforce jumped by 2.9%, the highest increase in labor productivity since the financial crisis. This also means a likely increase in US workers' pay, and therefore a long-term increase in GDP and inflation. The US economy and the US financial system are the only major developed economies (along with Germany), which actually increases the standard of living of their citizens after the financial crisis. This is most clearly seen in the GDP per capita chart for the major Western economies:

Graphics: WorldBank Data

The last accent of last week's economic calendar is US trade balance data. In July, the US trade deficit increased to $ 50.1 billion. Not only that, but the US trade deficit with China (the difference between exports to China and imports from China) is expanding to a record $ 31.1 billion. Despite customs and trade war, Trump's goal of reducing trade deficit with China is not just unsuccessful but counter-productive. The growing deficit points to a most likely reaction by Trump: escalating the trade conflict to the critical point, namely the duty on any Chinese imports.

What does this mean for Asian and European markets?

In our view, the combination of fundamental factors is a recipe for continued pressure on Asian economies by the end of the year. The factors are:

Trump's commercial policy, which is focused on delivering US advantage over trading partners; this policy is likely to be pronounced until the end of the US Congress elections (in November)

Slowing German economy and a weakly weak economy in southern Europe (France, Spain, Italy); currency and financial crises in emerging markets and debt deflation in China

Extremely strong (against the background of other economies) US economy

Increasing inflation (mostly in producer prices, wholesale prices), possibly wage increases (and therefore inflation) in the US, and increased inflation risk from the trade war with China

We see two, simplified scenarios that (though unrealistic and simplified) will guide us in the development of the current geopolitical and economic situation by the end of the US Congress elections (in November) and by the end of this year.

Scenario 1: Divergence Continues

In this scenario, the US economy continues to grow until the end of the year, while markets in Asia and Europe continue to soften.

This means that the strengthening trend in the US economy leads to an increase in workers' wages and an increase in production prices, possibly resulting in inflation. And the trade war increases the prices of products that are scattered between the US and China (most of the daily routine, from phones to cars), which further increases inflation. This means that the Federal Reserve's likely reaction would be to raise interest rates to fight inflation. This means a stronger dollar.

And growing trade deficits and budget deficits in the United States mean issuing more US bonds, and hence higher interest rates in the United States. Against the backdrop of a weak global economy and zero interest rates in most developed countries, investors are likely to continue to buy US government bonds. This means a stronger dollar.

In this scenario, the Federal Reserve is trapped in the US economy. The mandate of the Federal Reserve forces them to fight inflation.

The strong dollar inevitably puts additional pressure on non-US economies around the world: from China and Hong Kong to Turkey, Russia, and Argentina.

We visually imagine the scenario as follows:

The Federal Reserve is located between Scylla (inflation and strong economy) and Haridda (increasing deficits and hence debt repayment costs). The strong dollar means further pressure on the economies and currencies of emerging markets.

Scenario 2: Convergence Scenario

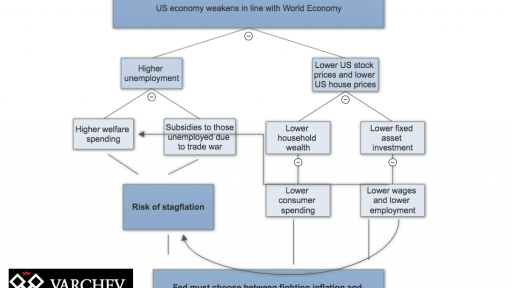

In this scenario, the US economy is weakening against the backdrop of a global weakening in the global economy. Most analysts and economists believe that in this scenario the pressure on emerging markets will be lighter. We think the opposite is more likely. The reason for this is structural.

According to most analysts, this will be a positive moment for emerging markets (as well as for Europe), because then the Federal Reserve will be able to cut interest rates. At lower rates, currency crises in emerging markets will calm down and liquidity will return to the global economy.

In our view, however, the Federal Reserve is unlikely to raise interest rates. Donald Trump's policy, increasing budget deficits and subsidies for US producers (for example, $ 12 billion for US soybean germ) is highly inflationary. If the US economy cushions against a background of a trade war, the political pressure on Trump would be to support US production with subsidies and aid to the poor. This, coupled with the inflationary pressure from the trade war, is a recipe for high inflation in the United States. The risk of this scenario is so-called "stagflation": high inflation and high unemployment / low GDP.

In this case, the Federal Reserve will be between Scylla (inflation) and Haribda (a decline in GDP). If the Federal Reserve decides to fight inflation by raising interest rates, it risks further weakening the economy. If the Fed decides to fight unemployment (low GDP) and cut interest rates, it risks rising inflation.

In each of these scenarios, risks to emerging markets remain. Even if the Federal Reserve does not raise interest rates and tolerate higher inflation, it translates into a higher dollar cost of raw materials: this is positive for emerging markets such as South Africa and Turkey, which export many raw materials (platinum, palladium, steel, gold etc.) but is extremely negative for economies such as Korea, China, India and the EU (especially Germany), whose economic development depends directly on access to cheap metals and other raw materials.

In the long run, of course, Scenario 2 is bearish for the dollar. Few currencies survive the combination of inflation, a weakening economy and widening deficits in the long run. The US dollar, however, is a reserve currency and there is currently no alternative to another currency reserve. This means that in the short term (3-6 months) rising interest rates will increase demand for dollars.

Source: World Bank

Trader Velizar Mitov

Trader Velizar Mitov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.