- Home

- >

- Daily Accents

- >

- Loss for a trillion dollars

Loss for a trillion dollars

The sale of European markets has deteriorated to such an extent that German senior Asset Management MPPM EK - Guillermo Hernandez Sampere has to spend half a day talking to customers on the phone who are scared, frightened and angry.

European stocks have lost investor confidence as a result of the negative turn of events around Italy and Brexit talks. "Selling causes pain and markets are killing us." - says Samper.

While many investors were hoping for a new rally in October, stocks and indices on major stock exchanges and companies continued to fall sharply down this month, driven by the rise in government bond yields to the Commerce War. European indices are the losers here, no matter what we see on American markets. European stocks have lost more than $ 1 trillion market value since the end of September. And now traders and investors are worried about the Italian budget and negotiations with Brexit.

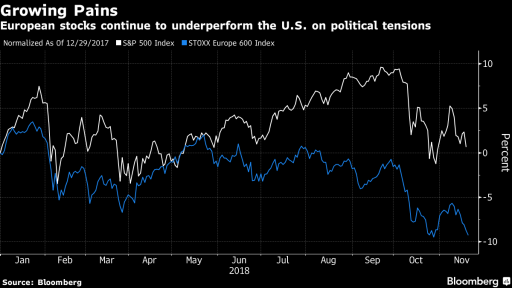

Stoxx Europe 600 was down 2.3% in November to date, down from the S & P500, down 0.8%. European indices failed to catch up with US growth, and the gap between them has grown steadily. Traders recommend staying in "cash" rather than going out with index or share positions. It's too risky.

"We need a catalyst to make us buy European shares, but it's hard to find one that investors believe." - says Ken Adams, Chief Strategic Planning Officer at Aberdeen Standard Investments. It adds: "The region is currently only disappointed in terms of growth expectations and, overall, the political picture is full of challenges."

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.