- Home

- >

- Daily Accents

- >

- Parabolic decline in the value of the TRY

Parabolic decline in the value of the TRY

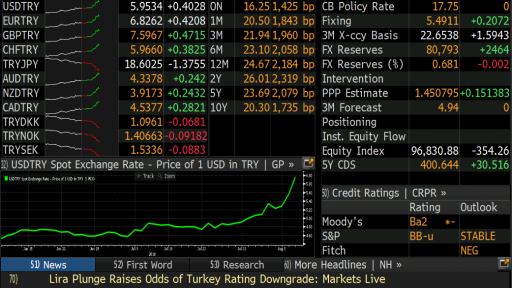

Diplomatic tensions between USA and Turkey reached peak levels, after threats of imposing sanctions on government-affiliated personnel from both sides of the conflict, sending the Turkish lira in a parabolic downward slide against the USD and other shelter-currencies. Inflationary pressure on the lira, combined with the populist politics of President Erdogan, caused serious losses in the value of the currencies from the beginning of 2018 (with the decline beginning in September 2017). After threats by Erdogan towards the Turkish Central Bank against raising rates (claiming that high interest rates cause high inflation), as well as hiring his son-in-law as president of the central bank, the lira accelerated its decline to extreme levels, reaching an intraday bottom (on the 10th of August) of 6.25 TRY per 1 USD. For comparison, in the beginning of 2018 the exchange rate between the lira and the dollar was 3.66 TRY for 1 USD.

As the chart below shows, the BIST 100 (Borsa Istanbul 100) has lost almost 50% of its value in USD from the beginning of the year. Beginning from 32 000 USD in 2018, the BIST 100 has slid to 16 445 now.

Erdogan’s unpredictable remarks and policy feed into the market’s anxiety that the Turkish and American president will not reach a consensus or compromise. Considering his remarks about speculators, his invocations towards the Turkish people to sell their dollars for Turkish liras in order to protect their currency from evil speculators, it seems unlikely that Erdogan will bow his head before the markets (as well basic economic and financial principles). His hardheadedness and populism is not madness, in my view. Erdogan understands Turkey’s position on the geopolitical scene. Turkey is one of the key allies of the US, in military, and the EU, regarding immigrants. Although for a long time Turkey leaned towards an alliance with the West, in the last year Erdogan has sought closer relations with Russia and President Putin. In this way, he is pressuring both the EU and the USA to consider making greater concessions to Turkey. Whether the USA and Turkey will reach a compromise to tame the panic depends on Presidents Trump and Erdogan, and their teams.

Anxiety that the weak lira will spill into connected markets caused GBPUSD towards 1.278, where the pair meets resistance, and the Eurodollar towards 1.143. Declines were also registered in currency crosses between the pound and euro on one side, and the safe-haven yen on the other: EURJPY fell to 126.78; as well as in GBPJPY, which sank to 141.5. The slide in European currencies, combined with the increased demand for dollars and yen, underline the mood for the beginning of the day: risk-off.

Used with permission of Bloomberg Finance L.P.

Trader Velizar Mitov

Trader Velizar Mitov If you think, we can improve that section,

please comment. Your oppinion is imortant for us.