- Home

- >

- Daily Accents

- >

- Pay attention to this bullish ‘chart of the week, month and potentially year

Pay attention to this bullish ‘chart of the week, month and potentially year

Another week, another set of records for the major U.S. indexes. Hey, this stock market stuff is easy, right? Sure, and it’s only going to get easier, apparently.

Now, “with the weight of a heavily handed Fed lifted,” the Macro Tourist’s Kevin Muir says, “stocks, and financial conditions, in general, will explode higher.”

Muir, making his bullish case in our call of the day, says stocks will continue to dare the Federal Reserve to lift interest rates.

Muir is contemplating a rather unorthodox approach to what he sees as an “inflection point” and ultimately a bullish “squeeze” play. He says that while the common belief is that volatility VIX, dips when markets rise, he is looking for a rally in both at the same time.

The chart

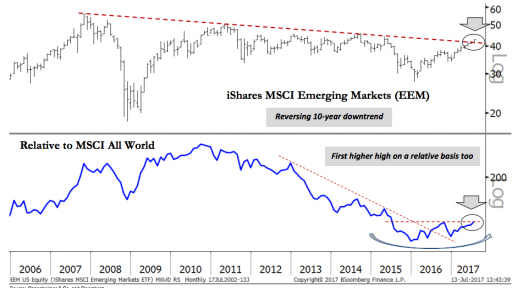

Oppenheimer’s Ari Wald calls this “our chart of the week, month and potentially year,” explaining that it “not only carries significance for the future direction of EEM’s trend — we think higher — but also for the cyclical recovery as well because broadening global participation remains a focal point to our outlook.”

As you can see, the iShares MSCI Emerging Markets ETF EEM, which has woefully underperformed the S&P 500 SPX, over the past decade, is breaking out of a 10-year downtrend and is also making a higher high relative to an MSCI global index.

Earnings

This looks to be a huge week of quarterly reports, following last week’s strong start that was led by some upbeat results from the financial sector. In total, we’ll get 68 of the S&P 500’s companies reporting, according to FactSet analyst John Butters.

36% — That’s what Trump’s approval rating over the first six months just plunged to, and it’s the lowest of any president. Ever. In the history of presidents.

Source: Bloomberg

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.