- Home

- >

- Great Traders

- >

- Peter Lynch: “The best way to invest is to look at companies competing in the field where you work”

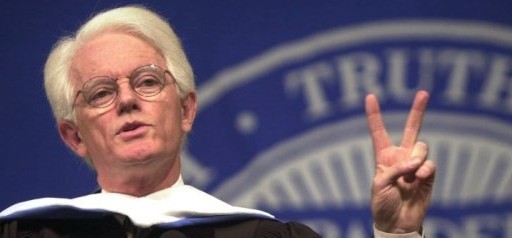

Peter Lynch: "The best way to invest is to look at companies competing in the field where you work"

Peter Lynch wants you to know that his ideas are being misquoted widely.

“I’ve never said, ‘If you go to a mall, see a Starbucks and say it’s good coffee, you should call Fidelity brokerage and buy the stock,’” Lynch says, more than 25 years after his retirement from running Magellan Fund was front-page news.

Following the market still at age 75, he instead explains his philosophy this way: Use your specialized knowledge to home in on stocks you can analyze, study them and then decide if they’re worth owning. The best way to invest is to look at companies competing in the field where you work. Someone with deep restaurant-industry experience would have predicted the success of Panera Bread Co. and Chipotle Mexican Grill Inc., he says: “If you’re in the steel industry and it ever turns around, you’ll see it before I do.”

What’s wrong with the popular-wisdom version of his ideology, which is usually cited as “invest in what you know”? It leaves out the role of serious fundamental stock research. “People buy a stock and they know nothing about it,” he says. “That’s gambling and it’s not good.”

Lynch was a mutual-fund rock star. When he ran Magellan, he says, one of every 100 Americans was invested in it. Though he is on boards at Fidelity Investments in Boston, since leaving fund management he has kept to philanthropy. With his late wife, Carolyn, who died in October, he ran a foundation that funded mainly educational and health-related nonprofits in Massachusetts and beyond, such as Teach for America, Partners in Health and the Posse Foundation. He managed the money and Mrs. Lynch chose the recipients.

The market is different than in 1990. One of the biggest changes: exchange-traded funds. Lynch credits their rise with a distrust of mutual-fund managers, which he says is unwarranted. “People accept that active managers can’t beat the market and it’s just not true,” he says.

Lynch’s advice for small investors: Picking individual stocks is hard even for the professionals. So “if you can’t understand the balance sheet, you probably shouldn’t own it.”

Even stars have bad calls. Lynch is known for a 13-year run of successes, but he quickly points out his missteps. When his daughters bought him an iPod, “I should have done the math” and figured out how much Apple Inc. was earning on the devices. He also missed out on, yes, Starbucks Corp. as well as Netflix Inc., even though he subscribes to the streaming-movie service.

Aside from physical therapy for his wrist and seeing his six grandchildren, Lynch spends time calling companies, listening to earnings calls and reading transcripts. He rarely travels to companies anymore, though he recently took a granddaughter to the Tootsie Roll plant in Chicago.

People still stop him in airports for a selfie. Strangers used to ask for stock advice (“That’s symptomatic of a bull market,” he says, “when the cabdriver gives you an idea and it goes up”). But on his past two trips, admirers didn’t ask, which could mean the bubble is ending, he says.

Lynch says he has no plans to abandon the stock market for other leisure pursuits. “It’s a fun exercise,” he says. “Beats the hell out of golf.”

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.