- Home

- >

- Daily Accents

- >

- Philip Lowe: “We remain neutral with regard to monetary policy”

Philip Lowe: "We remain neutral with regard to monetary policy"

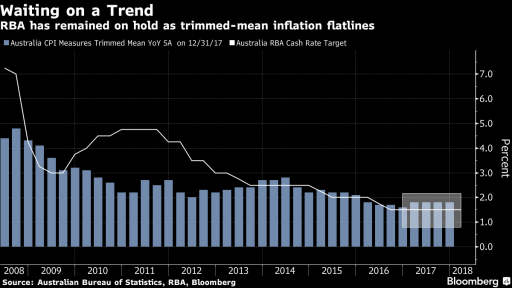

"Whether we are going to raise interest rates in 2018 for the first time in eight years depends on the progress of unemployment and the stabilization of inflation near our goal," said Philip Lowe, Reserve Bank of Australia Governor, during his speech, early today.

Here are the highlights of his speech and what to expect with AUD

The RBA is of the opinion that economic progress remains stable, but the central bank's board leaves room for a change in monetary policy to a looser one, if necessary, a behavior that we have seen for years in the eurozone. The RBA manager is firmly behind the opinion of a large number of market participants who believe that this year's interest rate rise is unlikely, as unemployment is far from healthy 5% and inflation below the desired 2%. While business investment has improved and their employment has increased, continuing labor market delays and firms that intend to reduce costs keep wages low. Over time, wages are likely to increase, but only then the RBA will raise interest rates very smoothly and timidly, probably again on the model of the ECB.

Currently, the AUD market response is extremely low, but this is a prerequisite for strong moves at the moment the RBA tune changes. The Australian apparently disregarded the interest rate differential with other banks and continues to rise, mainly because of the high profits of local corporations selling their commodities in US dollars, the currency that has not been particularly well-off in recent months. The weak dollar significantly increased Australian exports.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.