- Home

- >

- Fundamental Analysis

- >

- Pimco Bets Pound Plunge Is Far From Over as Brexit Clouds Gather

Pimco Bets Pound Plunge Is Far From Over as Brexit Clouds Gather

No happy new year for the battered pound, if you ask Pacific Investment Management Co.

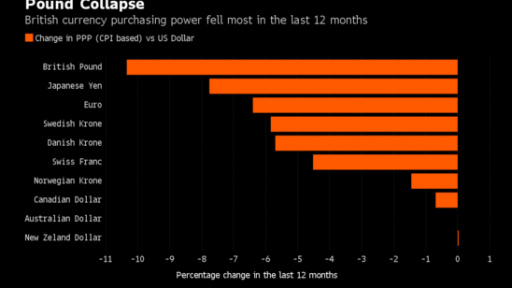

After profiting last year from sterling’s steepest slump since the global financial crisis, the money manager is betting on the drop extending well into 2017 amid political uncertainties and a current-account deficit. The pound has fallen more than 17 percent against the dollar since Britain voted out of the European Union in June and touched a 31-year low in October.

Sterling remains attractive to sell even as it’s now undervalued by about 5 percent based on purchasing-power parity, according to Thomas Kressin, portfolio manager at Pimco.

“The pound has one of the worst current-account deficits in the developed world and remains vulnerable to Brexit headline risks,” Munich-based Kressin said in a phone interview. The pound fell to as low as $1.2039 this week amid concern the U.K. is headed for a so-called hard Brexit, which could see the nation seek to regain control of immigration at the cost of having to quit Europe’s single market, as the government’s self-imposed March deadline for triggering Article 50 of the Lisbon Treaty approaches.

The British currency rose 0.4 percent to $1.2267 as of 2:51 p.m. in London. It lost 16 percent against the dollar and 14 percent versus the euro last year, the most since 2008. The U.K. had a current-account deficit of 25.5 billion pounds ($31.3 billion) in the third quarter of 2016, according to official data.

HSBC Holdings Plc forecasts sterling will drop to as low as $1.10 if the most severe exit option is pursued. The median estimate in a Bloomberg survey of forecasters is for the currency to slip 0.7 percent to $1.22 by mid-2017 and then to recover modestly to $1.25 by year-end.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.