- Home

- >

- Daily Accents

- >

- PMI from China and interest rates from Australia, what to expect

PMI from China and interest rates from Australia, what to expect

During the Asian session, we expect two of the most important news for this week, namely Caixin Services PMI from China and the RBA decision on Australia's basic interest rate.

1. Reserve Bank of Australia decision on the basic interest rate - 05:30

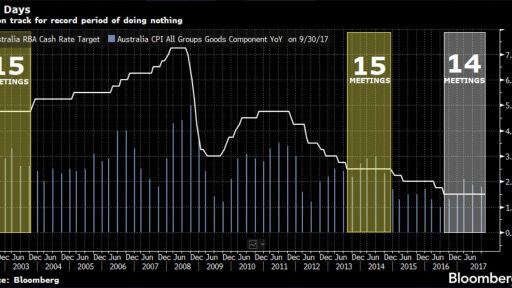

RBA is expected to leave interest rates unchanged at a record low of 1.5% for the 15th consecutive time as wage growth continues to decline. This will correspond to the periods of stagnation in 2014. and 2003, with expectations for most of RBA next year to remain firmly behind its position not to change the interest rate. Given this, the AUD will be quite sensitive to a change in the central bank's tone. With a change in RBA, we expect a strong AUD, while maintaining the interest rate, an increased volatility without major changes in the value of the currency.

2. Caixin Services PMI from China - 03:45

China PMI data will be published primarily by AUD and NZD traders, given the strong dependence of the Australian and New Zealand economies on China's. The indicator has no estimated data but takes into account the change compared to the previous month. The expectations of most market participants are that China will release better data than the previous month, and such news will positively affect AUD and NZD. Given the RBA expected interest rate level in Australia, we expect AUD to remain relatively calm during China's data, which will instead be more strongly reflected by the NZD. The data also have a strong impact on the Asian stock market, with the strongest impact on the services sector.

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.