- Home

- >

- FX Daily Forecasts

- >

- Possible positions on the FX market

Possible positions on the FX market

Two distinct drivers - monetary policy and political developments - continue to mould investor sentiment. With the weekend to digest Friday's US political headlines, the picture is not much clearer, and that uncertainty saw opening markets sell USDJPY as we have not likely seen the last of the vast divide among the GOP.

While there was little initial panic on Friday over the AHCA getting pulled, I suspect the markets will continue to view this failed vote as a litmus test for the ability of the Trump administration to drive the President's agenda going forward. How quickly the White House administration can pivot to and get a convincing message across on tax reform will likely be the major focus early in the week. The market is desperately seeking any glimmer of optimism that the tax reform agenda can unite Republicans.

Australian Dollar

A very light week for Australian data so look for external drivers to remain dominant. I suspect we will continue to see the Aussie's tight correlation with global equities play out and with so much uncertainty brewing on Capitol Hill investors' backbones will likely get tested out of the gates this week as stock markets will likely flounder.

In addition to the wobbly capital markets, iron ore prices rolled over, collapsing some 19 % last week as rebar prices slumped. Markets sideswiped by China property kerbs and hikes in China's repo rates that are designed to kerb excessive financial speculation as the mainland leaders appear determined about reining in unbridled debt-fuelled speculators.

Japanese Yen

The dollar has been under early pressure as the JPY is benefiting from the political uncertainty unfolding on Capitol Hill. Traders are are thinking we've seen the near term high water mark for USDJPY as the market views the AHCA debacle as a foreshadowing of a severe watering down of Presidents Trump's power in Washington. At a minimum, the lack of unity among the GOP suggests future Trump administration policies will be far from a rubber stamp. On Friday we saw a case of buying the rumour on the significant tax reform hope, but today we sell the fact of the great GOP divide.

Euro

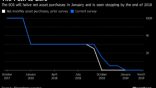

Ploughing through the 1.0830 level is very constructive for the EUR. The perception that political risks are diminishing in Europe but escalating in the US has the euro poised to make further headway. The apparent shift in ECB to a less accommodative stance has traders thinking policy pivot as the recent inflation, and PMI data supports this notion. In the euro, the bears ran for cover and the bulls ran with the wind at their back. The bulls added 11.3k contracts to their gross long position, bringing it to 159.6k contacts. Meanwhile, the bears covered 10k contracts to bring their gross short position to 179.3k contracts. The net short position was reduced to 9.7k contracts from 41.0k contracts, which is the smallest since mid-2014.

The most dramatic change was in the Canadian dollar futures. The bulls capitulated. The gross long position was slashed by 44.3k contracts to 30.3k. The bears were not as bold. They added 1.5k contracts to the gross short position, lifting it to 54.7k contracts. The net position swung back short (-24.4k contracts vs. +21.5k contracts) for the first time in two months.

SeekingAlpha

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.