- Home

- >

- Stocks Daily Forecasts

- >

- Possible sudden decline in markets, investors are leaving the market

Possible sudden decline in markets, investors are leaving the market

It was panic buying that pushed the Dow Jones and the S&P 500 indices to record highs. There is trouble brewing in this rally. Smart money has left the stock market, as the charts at the end of this article will show.

Wall Street insiders appear to know that something is seriously amiss with the economy, but no one is warning the retail investor.

The S&P 500 continues to develop and complete its broadening topping pattern

Insider behavior matters because research based on real-time signals has shown that a properly modeled picture of insider actions can provide the most accurate reflection of the prospects for the company, industry, economic sector, or even the stock market in general, going forward.

Daily Insider Buying Amount Is Down Sharply for 2016

From the chart we can see that the number of open positions is decreasing rapidly since the start of 2016.

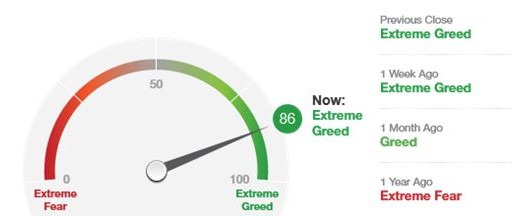

What Emotion Is Driving the Market Now??

It's displaying that the markets are way too frothy at the current reading of 86. It is important to note that this is a contrarian indicator, meaning it goes up when everyone is bullish and buying. Consequently, the market should be close to topping out and soon thereafter falling in value.

As the markets are pushing higher, investors tend to become warier by nature. This often leads to the markets climbing the proverbial "wall of worry." Are investors missing out on the opportunity of higher prices?

This Is Classic Negative Divergence

I believe the market is topping near these levels because of the divergence between the Dow Industrials and the Transports. The Industrials have made a new all-time record high, but the Transports have not.

One of the many near-term indicators that are being watched pertains to Dow Theory. It is one of the more visible core tenets of Dow Theory. It's important to see price confirmation (directionally) from both the Dow Jones Industrial Average (DJIA) and Dow Jones Transportation Average (DJT). The Industrials reached new all-time highs, while the Transports have not. The Russell 2000 (IWM) have NOT confirmed this high either, confirming there is a broad weakness in stocks. The Russell 2000 typically leads stock market rallies and selloffs.

The market trend is up when both forge higher highs. The market trend is down when both forge lower lows. A "non-confirmation" is present when only one forges a higher high, but other makes lower lows.

The Volatility Index (VIX.X) recently dropped to a multi-year low. It is now trading at levels where it was last August 2015, before it exploded to 40. In fact, the put/call options ratio and VIX are both at extremes, pointing to a significant correction in the next couple weeks.

Helicopter Money

During the last couple of weeks, gold prices have been in a corrective wave. However, this pattern calls for a continued uptrend to begin within the next couple of weeks.

Japan has promised to buy One Trillion Yen worth of new government debt, and perhaps even begin the "Helicopter Money" plan of direct government debt monetization going forward.

In Japan, where government bond yields have fallen below zero, and faith in "Abenomics" is flagging, gold sales are soaring. It is not unreasonable to expect the same here in the U.S. between now and November 2016 and beyond.

What's Next

Average market participants who are bullish on the stock market and feeling really great about their investments will soon be left holding a huge portfolio of stocks trading 30%-to-50% below the value they paid for them. Wall Street insiders have been and continue to sell their shares as they see the music stopping sooner than later -- and do not want to be the ones left holding equities when the bottom falls out.

When the stock market crashes, investors will seek refuge in precious metals and US government bonds.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.