- Home

- >

- Daily Accents

- >

- Pound Gains Seen at Risk on Anything Less Than a Wide Tory Win

Pound Gains Seen at Risk on Anything Less Than a Wide Tory Win

The pound’s recent gains against the dollar and low volatility in the currency could end on any outcome

other than a wide win for Theresa May’s Conservative Party in Thursday’s U.K. elections.

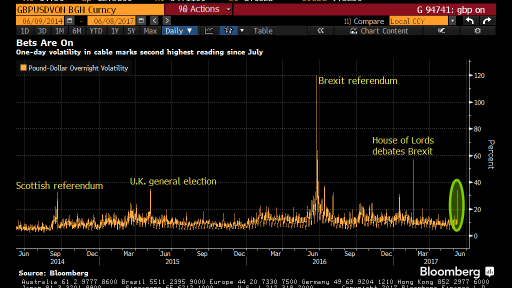

It’s certainly not the first time currency investors have underplayed political risks, especially in the cash market. Compared with past events that carried significant tail risks, option traders appear less worried about a surprise result this time. The spread between the pound’s one-week and three-month

implied volatilities widened sharply in June, yet remains well short of the highs seen during the Scottish referendum, the 2015 U.K. election and the Brexit vote.

The odds of a Tory victory now stand at 93 percent, as suggested by the average implied probability based on bookmakers’ quotes. An electoral upset involving a Labour Party win or a hung parliament remains a tail risk for option traders: three-month pound-dollar implied volatility has dropped in June and now trades near 8 percent, clearly within its downward trend channel since the Brexit referendum.

Unless there’s a significant increase in U.K. political uncertainty, long-volatility trades may see little demand as summer lull takes over and with Brexit negotiations likely to drag on for a considerable amount of time.

Still, investors looking to hedge all election outcomes must pay a stiff premium. Overnight volatility in the pound- dollar pair more than tripled Thursday to 34 percent, suggesting

a one-day breakeven close to 200 dollar pips. With sterling trading near 1.2970, a long-volatility trade would become profitable outside the 1.2760-1.3160 range. Bloomberg’s foreign-

exchange forecast model assigns a 36 percent probability to that prospect.

Spot traders don’t look that worried that the election outcome may be anything other than the widely expected comfortable win for the Conservatives. While the cost to hedge cable declines via options has surged in the short tenors as shown by risk reversals, sterling has managed to remain stable

in the cash market and was up for a second week versus the greenback.

Whatever the election result, the pound may finally bridge the gap between its performance versus the dollar and that against other major currencies. Even as the U.S. currency makes up more than a third of the Bloomberg Pound Index, the latter has widened its divergence versus cable since mid-May.

While a Tory win could see the index creeping higher as the greenback’s losses stay confined, anything else could see cable diving to catch up with other pound pairs.

Source: Bloomberg Pro Terminal

Trader - Senan Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.