- Home

- >

- Daily Accents

- >

- Powell patient to the economy, but ready for action, stocks reacted positively

Powell patient to the economy, but ready for action, stocks reacted positively

Federal Reserve Chairman Jerome Powell said the central bank could be patient after reassessing the risks to the US economy, adjusting the speed of its policy to the economy and, if necessary, reacting quickly to change.

"With the creeping inflation we are watching, we will be patient until we see the economy progressing." "Powell said today at a press conference with Yellen and Ben Bernanke at the annual American Economic Association in Atlanta.

"We will be ready to make the necessary changes in monetary policy quickly and flexibly and we will use all available instruments to support the economy within acceptable growth margins to maintain stable economic expansion." Powell added in his statement. "We have no prior policy path to follow".

As a result of this speech, US stocks have gone up.

Powell and colleagues from the central bank weighed the consequences of the various contradictory signals from the US economy. They are trying to maintain their main goal they have set for this mandate, and it is to maintain low but stable inflation and full employment on the labor market in the long run.

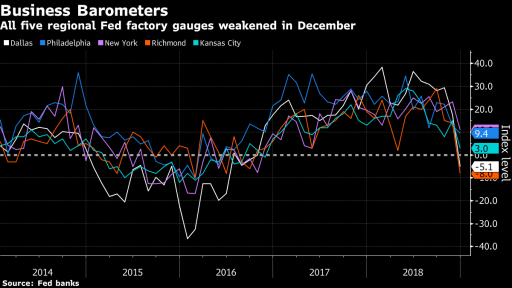

Color markets hit the whirlpool of the rapidly changing sentiment, which eventually led to massive sales in all regions in recent months. This has been the result of a slowdown in production indicators around the world and the trade-offs between the US and China, which has aggravated the uncertainty surrounding the negotiations.

Indicators of consumer attitudes and confidence also began to weaken, while households reported a weakness throughout 2018.

Despite the negative outlook, the Fed is very close to achieving target 2% inflation. For most of 2018, the indicator stood around this figure, but in November inflation fell to 1.8%.

FEDs also remain below the desired labor market rates and are still far from full employment. NFP data posted an increase of 312,000 this month, which was above expectations. Average hourly earnings increased 3.2% from a year earlier, this is the fastest rate of growth since 2009. The unemployment rate is 3.9%, which is the lowest for the past 50 years, meaning that more people in the United States have been actively looking for a job, finding it and working.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.