- Home

- >

- Daily Accents

- >

- Precious advices from George Soros

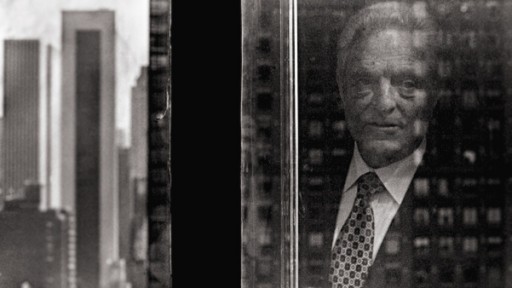

Precious advices from George Soros

1. Brokers: Finding the one broker who is actually in tune with your style of investment is essential. Once you find the right broker, stick to that person as a person.

2. Leisure Time: Sometimes investors forget one very crucial thing – living. Take a break from the busy world of investing and do remember to spend quality time with your loved ones.

3. Trial & Error: Form a hypothesis and get the opinion of others on it. When we take in inputs from people, we are able to get a better perspective. Once we actually form one, we can apply it in reality. If the thesis works good in the market, try and stick to it else withdraw from it and go for a new one. Trial and error is best for stocks.

4. Withdraw: If you are facing nothing but continuous losses in the market, it is better to withdraw your money and start afresh. The idea is to begin again with renewed vitality and optimism.

5. Investing: If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring and personal emotions have no place in investing. If you want to be successful in the long-run, base your investment decisions on rationality and discipline.

6. Mistakes: I’m only rich because I know when I’m wrong. I have survived by recognizing my mistakes. You must recognize and admit your mistakes when you make them, cut your losses short, and move on to the next logical step.

7. Scenario Planning: The financial markets generally are unpredictable. Successful traders abide by this philosophy by heart. Markets truly are random and no one knows where, when, and how prices will move. The biggest opportunities lie in those unexpected events because most people are betting on the obvious, and in the market, most people are wrong. The key is to be ready for every scenario that can happen so that you can take advantage of the opportunities that lay ahead.

8. Turnaround: The worse a situation becomes, the less it takes to turn it around, and the bigger the upside. This is true in life as well as in investing. When you hit rock-bottom, every inch of improvement feels so much better and powerful.

9. Stock Bubbles: Stock market bubbles don’t grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception. Stock market bubbles start with good corporate or economic fundamentals. Things just go out of hand when people’s misguided greed comes into play.

10. Keep Things Simple: The more complex the system, the greater the room for error. A simple but effective investing system will always beat the crap out of a complex system that doesn’t work.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.