- Home

- >

- Daily Accents

- >

- Quant Factors Go Silent in U.S. Stocks Raising Leverage Par anoia

Quant Factors Go Silent in U.S. Stocks Raising Leverage Par anoia

Quant Factors Go Silent in U.S. Stocks Raising Leverage Paranoia

The pain of an almost paralyzed stock market has seeped its way into the money machine of equity quants, raising anxiety levels among analysts who say they’ve seen this movie before.

It’s below the surface, where collections of look-alike stocks grouped according to investment traits like cheapness or profitability have fallen into even deeper slumber than the market as a whole. Average daily price swings in market-neutral momentum and volatility are the smallest in four years, data compiled by Bloomberg show.

So puny are the payouts that concern is building among analysts that quantitative managers will react by taking ill- advised risks. Rarely ones to wait, traders in this mathematical soup sometimes look to juice up returns.

“If you’re in a long-in-the-tooth factor that everyone is involved in, that’s going down in volatility, one way to offset the reduced returns is with leverage,” said Mark Connors, the global head of risk advisory at Credit Suisse Group AG. “For any event, whether it’s a blip or a big macro event, there’s then a greater change of sharp deleveraging.”

Connors says clients have been calling his desk to report signs of rising leverage in markets. They also want to know if this could lead to forced selling among quant funds that control as much as $500 billion.

If it all sounds a little overbaked, the narrative has precedent in an event known as the “quant quake” of 2007, when hidden market dislocations caused a chain reaction of selling among program funds. Then as now, rumblings broke out at a time of equity torpor, with the VIX dipping below 10 and markets acting immune to all kinds of risk.

Quants like to say they’re uncorrelated with other assets, an attractive characteristic when the market goes dead. But they don’t look very uncorrelated right now. Long-short portfolios turned to factors are as zombified as everything else.

Market-neutral momentum and volatility, for example, are on track to post the calmest year since 2013, as judged by their average daily price swings, according data compiled by Bloomberg. Profitability, growth and size have been moving more than 13 percent less than their nine-year average.

There’s not much to do to combat the muted movements. Sure, you could dig for lesser-known factors that provide higher returns, but it’s a daunting task requiring increasingly expensive and elusive data. (Some shops to invest in

crowdsourcing.) Failing that, there’s only a handful of widely accepted factors, so quants may be taking similar bets with more money backing them to juice returns.

“There’s not much meat left on the bone,” said Connors.

“The bear story is that they’re all in the same trade.”

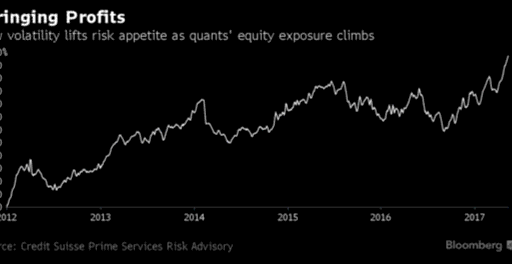

Crowdedness is the essential ingredient in a selloff and quant gross exposure to the equity market is the highest it’s been since Credit Suisse began tracking the data in 2012. Though it captures the growth of the industry, the gross exposure may also suggest leverage at play, said Connors.

Still, Credit Suisse analysis suggests that one day of volatility, especially those of the politically induced nature like Wednesday, would not cause any significant deleveraging. A shock in rates or currency — typically low volatility assets — would be needed for a big reaction, said Connors.

Even if a risk event does occur, there could be a silver lining. More volatility could also mean more opportunity, according to Alan Marantz, a partner at Fort LP, a Chevy Chase, Maryland-based quantitative hedge fund which manages more than

$3.5 billion.

“In the short term, with volatility low and the market moving sideways, there’s less risk currently but investors increase risk to achieve returns in these environments,” Marantz said. “If managers need to exit, arguably that could create more opportunity for us because we’re trying to find companies trading at attractive valuations, and they get inexpensive because the market is trying to sell them for some reason.”

Source: Bloomberg Pro Terminal

Senan Fuchedzhiev - Trader

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.