- Home

- >

- Stocks Daily Forecasts

- >

- Rare Long signal gives Bull power

Rare Long signal gives Bull power

The risk-parity strategy has found gains after a turbulent stretch. But the relationship between bonds and stocks going forward may be rockier. Barring a massive equity selloff this afternoon and tomorrow, the S&P 500 is heading for a weekly gain, ending two consecutive weekly losses in stocks and bonds.

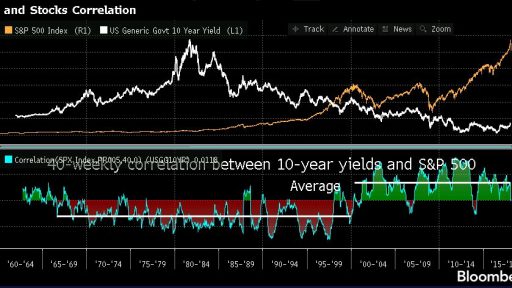

In recent years, a three-week losing streak in bonds and stocks has been rare. The last time it occurred was in 2004 and it happened only three times in the last 20 years, Alan Ruskin at Deutsche Bank noted in a report. Here's a look at the number of weeks when 10-year yields rose and the S&P 500 fell in each year since 1968. The average number of weeks of simultaneous selloff has fallen from 13.5 during the 1990s, to 8.7 in the 2000s and 5.9 since 2010.

Ruskin's takeaway is that bond bears typically run out of steam when equities are persistently weak. It's interesting to note that the correlation between bond yields and stocks has turned positive (bonds rise, stocks fall), from negative (bonds fall along with stocks) since 2000, when inflation expectations become more anchored. There's no reason to suggest that expectations are becoming unhinged, signaling that the correlation may largely be maintained.

But as fellow blogger Cameron reminds us, the correlation could be more volatile as the business cycle matures. (See the noted pickup ahead of recession in the first bar chart.) What the last two weeks have showed us is perhaps an earlier warning sign for risk parities, especially when bond term premium normalizes and the valuation of the equity market is already high.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.