- Home

- >

- Fundamental Analysis

- >

- Rate cut looks more likely. The question is when and with how much?

Rate cut looks more likely. The question is when and with how much?

Three major issues arise on the agenda before Jerome Powell and his colleagues when it comes to reducing interest: whether to do so, when and how much.

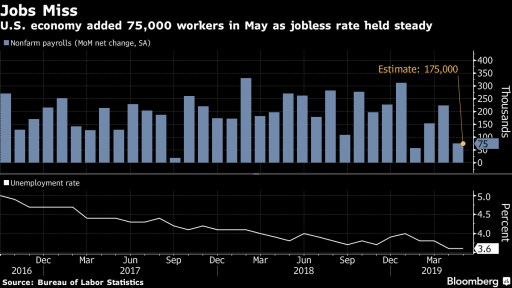

Analysts say an unexpected weakening of the US labor market in May will further increase the likelihood of the central bank lowering interest rates this year. This decision can be reached even after the tariffs canceled against Mexico.

In particular, uncertainty remains about when exactly the FED will operate and how much the interest will be reduced. Conservative approach within 25 points or more aggressive than 50?

Poor data on jobs came out against soft data on retail sales, industrial activity and consumption, as well as the still high tension between the US and China.

According to Bank of America, the Federal Reserve will send an even stronger dovish message to the markets in June.

Since January, the Fed has been characterized by a "patient approach" that will most likely be rejected. In his place, something that Powell has already hinted at last week - FED will closely monitor economic data, ready to act to ensure economic expansion.

This hints at the idea that the central bank will act as soon as possible, than to postpone further.

There is still a trade-off with China and the likelihood of tensions with Japan and Europe.

However, the FED must carefully assess how much to reduce interest rates. If they act too aggressively, for example 50 points, this may scare investors. They may think that the central bank in its panic assumes that the US economy will be slowing far more than expected.

Powell and his colleagues, however, can afford an aggressive move. While inflation remains under strong pressure, it will also give them the peace of mind to take a bold move. It is the weak inflation that gives them the real reason to lighten politics.

Naturally, they will face strong criticism of succumbing to political tension by circumventing Trump in his presidential campaign in 2020. Trump did not miss to mention in his latest tweet that the stock market could have been 10 000 points, and growth even stronger if the FED did not raise interest rates.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.