- Home

- >

- Great Traders

- >

- Ray Dalio: A slight change in thinking can make you rich

Ray Dalio: A slight change in thinking can make you rich

To some, this working style might seem radical. To Ray Dalio, it was the key to bringing his business back from the ashes.

At one point, the founder, chairman and CIO of investment firm Bridgewater Associates had lost so much money that he had to let most of his employees go. "I had to borrow $4,000 from my dad to help to pay my family bills," Dalio says.

Today, he's one of the world's most successful entrepreneurs and investors. Dalio is reportedly worth $17 billion. His investment firm is one of the largest hedge funds in the world. Did he just get lucky? There's no such thing.

In his recent TED talk, Dalio shares how he built his business back up after one of the greatest failures of his life.

Rising from the bottom

Before suffering his great financial loss, Dalio had been wildly successful in the stock market. He thought he knew how the game was played. Then the debt crisis happened. Dalio realized his arrogance had gotten the best of him. This painful experience was also an important learning experience.

Rather than thinking, "I'm right," I started to ask myself, "How do I know I'm right?"

Dalio realized his arrogance was entirely to blame for his failure. It was time to take a different approach that embraced humility.

May the best idea win

Enter the workplace culture strategy that Dalio attributes Bridgewater's current success. He calls it idea meritocracy. He no longer wanted to be the guy who fearlessly leads while everyone else follows. Instead, he tried an approach that would let the best ideas of the group win out over one particular person's opinion.

And in order to do that, I realized that we would need radical truthfulness and radical transparency... people needed to say what they really believed and to see everything.

So what does that mean exactly?

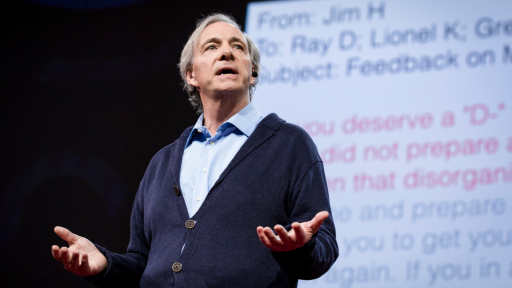

If he's falling short, Dalio wants people to call him out. They actually do it, too. In the TED talk, Dalio shares the text of an email from an employee who scolds him for showing up to a meeting unprepared and disorganized, making the entire meeting less productive for all. The employee goes so far as to grade Dalio on his performance. He gave him a D-.

Most CEOs don't want to be told they screwed up. Dalio does. "It's great! I needed feedback like that," Dalio says. Letting employees share their points of view helps him improve. And the feedback is public so other employees can learn, too. That's what an idea meritocracy is all about.

Now I know what you're thinking (because I was). Every organization has untouchables. They can take controversial viewpoints because they're already at the top. Sure enough, the guy who called Dalio out on his poor performance is Bridgewater's Director of Portfolio Strategy -- pretty high up.

But Dalio swears the radical transparency ideology applies across every level of his organization. "Jen, who's 24 years old and right out of college, can tell me, the CEO, that I'm approaching things terribly," he says. He's even designed an algorithm that accepts people's opinions during a meeting, then spits out all the results to compare.

Dalio believes everyone is entitled to their opinion. But that doesn't mean one person is more right (or wrong) than the next. One single viewpoint should never prevail. The best ones should.

Collecting all these viewpoints, opinions and feedback seems like a whole lot of work. Is it worth it? Absolutely, Dalio claims.

"It's given us more effective work, and it's given us more effective relationships," says. He can back it up with numbers, too. Bridgewater has made more money for their customers than any other hedge fund over the past 23 out of 26 years.

Dalio acknowledges this way of operating won't work for everyone. It takes about 18 months to become comfortable with the process. And 25 to 30 percent of people simply aren't suited for it. But for the rest, this approach can radically transform how business gets done.

Dalio closes his talk by encouraging the audience to consider how this might affect their own day-to-day lives. "Observe yourself in conversations with others," he suggests. "Imagine that you knew what they were really thinking. Imagine you knew what they were really like. Imagine if they knew what you were really thinking and what you were really like."

Sounds kinda scary. But also freeing. It just might be time to insert a dose of radical transparency.

Source: Inc.com

Jr Trader Petar Milanov

Inc.com: The Simple Shift in Mindset That Took This TED Speaker From Broke to Billionaire

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.