- Home

- >

- Great Traders

- >

- Ray Dalio: Most of the Bridgewater employees do not last more than 18 months

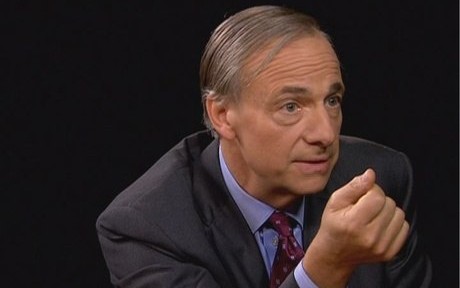

Ray Dalio: Most of the Bridgewater employees do not last more than 18 months

At the Westport, Connecticut-based hedge fund — the world's largest, with $169 billion in assets — all meetings are filmed and with very few exceptions made available to employees. Employees rate each other's performance using proprietary iPad apps to publicly display averages in "baseball cards" for each person, and criticizing colleagues behind their backs will get you fired.

The foundation for this culture is founder, chairman, and co-CIO Ray Dalio's "Principles," a manual of 210 lessons that all employees must be intimately familiar with.

Dalio readily admits that the culture is not for everyone. In 2014, he told UVA's Darden School of Business professor Edward D. Hess that the attrition rate over an employee's first 18 months was 25% — that is, one in four employees didn't last over a year and a half.

Dalio explained why it can be difficult adapting to his company's way of doing things: Most people have a hard time confronting their weaknesses in a really straightforward, evidence-based way. They also have problems speaking frankly to others. Some people love knowing about their weaknesses and mistakes and those of others because it helps them be so much better, while others can't stand it. So we end up with a lot of people who leave quickly and a lot of people who wouldn't want to work anywhere else.

A person who does decide to stay, he continued, "likes learning more than knowing and recognizes that the best learning comes from making mistakes, getting good feedback, and improving as a result of it. This requires people to be very humble and very open-minded because they realize that what they know is small in relation to what there is to know — and that what they don't know is what can really hurt them. It's also a great place for people who like being thrown into a rapidly changing place with plenty of ambiguity."

It doesn't take long for people to realize whether or not they want to work in a setting where there are few secrets among employees. But those who do decide to stay do so with an intense dedication to playing their part in Dalio's massive machine.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.