- Home

- >

- Great Traders

- >

- Ray Dalio: “I’ve accomplished enough. I don’t need more money.”

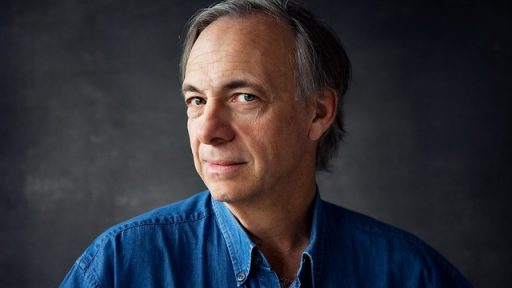

Ray Dalio: "I've accomplished enough. I don't need more money."

"I've done enough. I don't need more money." When most fund managers say something like that, usually people respond with mistrust and skepticism.

Unlike most Silicon Valley billionaires who believe (or are at least partially convinced) in the meaning and purpose of their mission, the motives of a Wall Street titan are more compelling: everything is about money, and when they have grown significantly, it is already based on glory and on building something more - a covenant.

Ray Dalio, however, is someone we would believe when he utters these words. We would believe in his sincerity. However, this does not rule out the likelihood that it will continue to significantly increase its condition. In fact, last year the financial press made enough noise about the impressive results of Pure Alpha, which is Bridgewater's flagship fund.

But when you spend some time with Dalio and talk about different topics, especially those in which he is an expert, you will understand one thing: the most famous hedge fund manager in the world is interested in at least making an extra climb in the world of megaboons or achieving of more glory and success for yourself.

Despite his diverse interests as a philanthropist, he remains in a strong position as co - CIO of Bridgewater. It gets a hefty amount of money for a person who has little time to use inefficiently or deal with crap. His other mission is to disseminate his philosophy - his principles for decision making and the coming of the new paradigm. Dalio believes that it is precisely the shift in paradigm that will completely change markets and the economy globally.

Dalio steps on two pedestals - the radical transparency and the radical principle of telling the truth. The billionaire believes that the principles that drive Bridgewater can even relate to one household. Some believe the principles are controversial and rather harsh. Principles such as: "Beware of the impractical idealist" or "don't expect people to take responsibility by acknowledging and acting right after their omissions and mistakes."

Dalio's 2017 bestseller "Principles: Life & Work" reaffirms his mission, but his book does not concentrate on compulsory adherence to philosophy. The lack of interactivity and the prerequisite for the actual implementation of his principles made Dalio turn to the digital format and published another book - Principles for Navigating Bid Debt Crisis.

Dalio and its PRIOS partners work hard to disseminate principles and make business and life decisions to them. Along with his responsibility to navigate the fund among the markets, he also finds time to accomplish one more thing: speaking, writing and teaching about the current state of the economy.

He identifies himself as a diagnostician who looks at the problems of the economy and looks for potential solutions to the problems. For example, in his most recent speeches, he criticized the US economy, saying that widening the gap between classes of opportunity, income growth and wealth would lead to "dangerous social and political divisions that would threaten the essence of capitalism." Dalio believes that the current US economic system cannot provide a fair enough opportunity for 60% of the US population. He also noted serious gaps in the education system. "If you live in a place where revenues are high, you will have a better education. But the changes we are seeing now create a big gap in the education system. Tragic wastage of resources." In another example, Dalio predicts a future that he calls "Monetary Policy 3". It thus defines the coordinated expansion of fiscal and monetary policy that occurs during the diminishing effects of quantitative easing. His opinion on Bitcoin / Libra is that the whole idea of decentralized money will have a dramatic effect on the economic system.

As a dedicated gold backer, the fund manager believes central banks will look for ways to depreciate their currencies. Again on the Bitcoin topic, Dalio is of the opinion that Bitcoin cannot be easily implemented as a payment mechanism, and its speculative volatility undermines its effectiveness as a means of accumulating wealth. The analogue with gold, as a means of preserving value, hints at the historical disconnect with precious metal. Just as it was banned and rejected, so could Bitcoin do the same.

Against the backdrop of his critical views on the economy and markets, there is a continuing irritation to US policy. He sufficiently shares his concerns that the US political process has deviated significantly from resolving disputes in a productive manner without mentioning names and indicating political leanings.

But so much for politics and economics. Dalio also has a lighter, less critical side: the music. And this has to do with another of its distinguishing points: Beatles' music was followed by engaging in transcendental meditation (TM). He attached importance to TM for the success of Bridgewater or ... the Beatles rather. However, the Beatles are not the centerpiece of inspiration for Dalio. This place is occupied by Aretha Franklin.

Photo: Flickr

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.