- Home

- >

- Great Traders

- >

- Ray Dalio with a grim forecast for the US, if the Fed fails to take into account the middle-class income

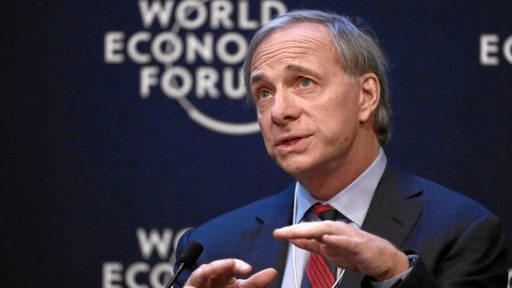

Ray Dalio with a grim forecast for the US, if the Fed fails to take into account the middle-class income

Founder of Bridgewater, the world's largest hedge fund, managing over $ 160 billion, publishes in stunning statistics about the US economy and proposes splitting in two. Dalio suggests looking at the country's population by dividing it into two groups, the first 40%, a group made up of that part of the population that is characterized as richer than the middle class and a group of 60% representing the population living below the average quality of life.

The purpose of this exercise is to show that while the underlying economic data that investors are seeing are rising, there are others that need to be addressed. Here are some of the indicators that investors should follow:

- Real Income: Income for most members of the group is 60% slightly down and the lowest since 1980. while the real income of the group 40% has risen significantly.

- Top 40% of people have nearly 10 times more wealth than those in the group at 60%. Compared to 1980, this indicator has grown 6 times. In other words, the middle class disappears in the country.

- Due to the underprivileged middle class population, a smaller percentage of the second group manages to spend money on saving or buying financial assets. Only a third of these 60% manage to build pension accounts.

- For the poorest of the second group, premature deaths have risen by about 20% since 2000. as a major contributor to this is suicide and death after receiving an overdose of drugs.

- As long as the poorest spend more money on food, the population in the first group spends about 4 times more money on education.

- The average income of non-tertiary graduates is half that of college graduates.

- Since 1980 divorces have increased by 20% and the number of non-labor white people has increased from 7% to 15%.

In other words, the US economy is not as strong as everyone thinks. According to Dalian, the differences between the two groups will continue to increase over the next 5 to 10 years due to demographic and technological changes.

For this reason, Dalio said the Fed made a mistake with its monetary policy as it considered the middle class as stronger than it was. If the Fed continued to raise interest rates would put heavy pressure on the middle class in the country, and this would lead to a sharp contraction of consumption, and hence a fall in the stock market.

"In my opinion, the Fed should focus on the poorer group and pursue its policy toward their needs rather than the needs of the richest"

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.