- Home

- >

- Market Rumours

- >

- Relief rally is here. Enjoy it while it lasts.

Relief rally is here. Enjoy it while it lasts.

For the first time this year, the bulls are showing their horns.

The S&P 500 Index and the Dow Jones Industrial Average closed their first positive week in the last three, renewing confidence in the otherwise gloomy market environment. According to one technician, a bottom could be in place for the very near-term—at least for the time being.

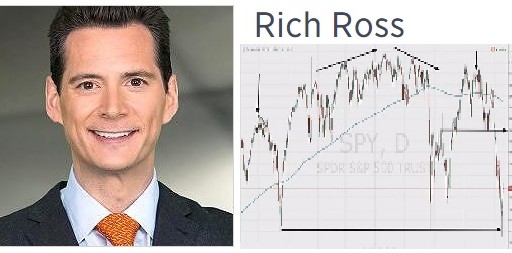

"The first thing we see [on the charts] are the textbook signs of short-term trend exhaustion," Rich Ross, head of technical analysis for Evercore ISI, told CNBC's "Trading Nation" this week. The S&P 500 saw its best trading session in more than a month on Friday.

Looking at a chart of the S&P 500 exchange-traded fund (ETF), the SPY, Ross pointed what he calls a three-day pattern of "exhaustion, stabilization and follow through" that formed on the chart in recent days. He pointed to the low seen mid-week as the exhaustion phase, the rally on Thursday as the market trying to find footing, and the continued strength during Friday's session as a confirmation in trend. "I think that sets the stage for some short-term relief that could take us higher," he said.

For Ross, the S&P 500 rally another 5 percent over in the next several sessions, with the SPY going as high as $200 before resuming its downtrend. On Friday, the fund traded around $190.

For Ross, the S&P 500 rally another 5 percent over in the next several sessions, with the SPY going as high as $200 before resuming its downtrend. On Friday, the fund traded around $190.

Outlook still negative

Ross, who correctly called for a break below 1,900 in the S&P 500 a few weeks ago, ultimately believes that the market will retest its Wednesday low of roughly 1,812, which translates into $181 on the SPY.Looking at a longer-term picture, Ross noted that there could still be significant downside ahead.

"It looks to me like we're forming the neckline of a big head and shoulders top," said the analyst. "A break below that neckline gives us a confirmed breakdown that sets us up for a deeper pullback," he said.

For now, added Ross, enjoy the bounce while it lasts.

(source: CNBC)

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.