- Home

- >

- Daily Accents

- >

- Repatriation of profits may have a stronger impact on technology bonds

Repatriation of profits may have a stronger impact on technology bonds

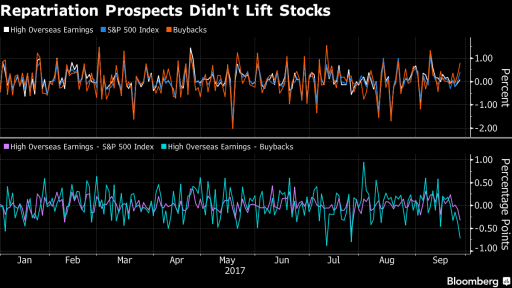

Trump tax plan has been spoken since last year, and market participants have already traded potential stock price changes. Shares of large-volume companies abroad have already reflected the changes, while large tech companies' bonds are trading without major changes, "said Peter Boockvar, Lindsey Group Market Analyst.

Boockvar highlights Apple Inc., Microsoft Corp., Oracle Corp. and Cisco Systems Inc. as companies that have increased their debts while generating money, many of which have been generated and held outside the United States.

Overall, over the past three years, these four companies have added $168 billion to their balance sheets and debt of $174 billion. Thus, it can be argued that much of their repatriation was made by increasing the debt, which then mainly used for redemption of shares.

For this reason, a good deal is for investors to buy long-term bonds of these companies.

Boockvar still expects buyback to give a positive impetus to US stocks but warns that they may not be as big as investors expect.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Bloomberg: Repatriation May Make Big Bonds Bigger Winners Than Stocks

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.