- Home

- >

- Daily Accents

- >

- Retail futures: Trading is trending

Retail futures: Trading is trending

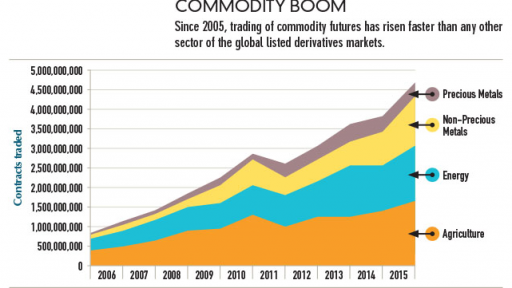

Futures markets have changed immensely during the last 10 years. The change is mostly due to electronic trading, which gives traders the ability to trade the E-mini S&P 500, crude oil, gold and more, side by side to equity products like Apple (AAPL) and Google (GOOG) by simply moving a mouse. In the past, many people heard the term futures, and thought of institutional traders, pit traders in bright jackets and professional hedgers. Retail traders, who had not grown up in the futures space, did not stand a chance among those types. However, times have changed. Today, co-location notwithstanding, retail traders are on a more equal footing and constitute a considerable amount of trading volume, making them a significant factor in the market (see “Commodity boom” below).

Despite initially being met with protest, electronic trading now accounts for the majority of trading in the futures industry. While futures markets were undergoing technological changes, many participants were unaware of the benefits it would create for the industry as a whole. Due to the ease and accessibly of electronic trading platforms, traders can efficiently execute orders from anywhere. This gave rise to new demand for futures from traditional equity traders. In response, retail brokers had to provide access. Now, there is more liquidity than ever in the futures marketplace. Liquidity is one of the most important components traders should focus on when looking for a market to trade. Without liquidity, a winning trade can quickly turn into a disaster. If a trader is unable to close a position, or has to pay a high toll getting in and out of a trade, risk becomes a major factor. Ideally, traders want to be able to place a market order at any time and not lose their shirt due to slippage. The increased liquidity provided by electronic futures trading also leads to the stabilization of the markets because pricing is more efficient.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.