- Home

- >

- Cryptocurrencies / Algotrading

- >

- Ripple, next stop at $0.60

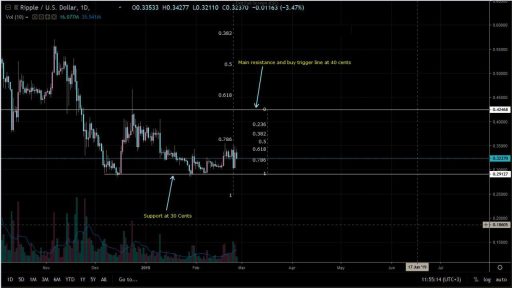

Ripple, next stop at $0.60

The space is getting clear and after the liquidation on Feb 24, Ripple (XRP) experienced the “CoinBase Effect”. The result is a temporary surge of XRP prices after an announcement that the crypto exchange CoinBase will allow their customers to trade XRP.

Obviously Ripple (XRP), which is one of the best performers, is up 5.2 percent for the past 24 hours. When we keep in mind the liquidation of Feb 24, we are convinced that is was a shakeout and every low will remain to be another spring board for buyers aiming at 60 cents and even 80 cents.

After the Feb 25 upswings, 30 cents is proving to be a solid base on which the traders can build on and race higher. Despite recent liquidation and the failure to get above 34 cents, the failure to drive prices below 30 cents reaffirms the outlook that buyers are in control. Risk-off traders can take a neutral but bullish stand until there are high volume buys above 34 cents. Thereafter first targets will be at 40 cents.

After Jan 30, market participation levels have been on the rise off 30 cents. Averages rose from 17 million to 34 million, doubling in less than 4 weeks. Despite that the inability to break above 34 cents means prices are accumulating in readiness for a rally thanks to increasing volumes and higher lows and highs. The volumes that could push prices above 34 cents towards 60 cents should exceed 52 million of Feb 24 and of Jan 10—83 million.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.