- Home

- >

- Stocks Daily Forecasts

- >

- Robert Doll: Rising rates don’t kill bull markets

Robert Doll: Rising rates don’t kill bull markets

The prospect of rate hikes seems to freak out investors, but historical data shows that bull markets in stocks usually keep on trucking along, albeit with some short-term bumps, once the Federal Reserve goes into tightening mode.

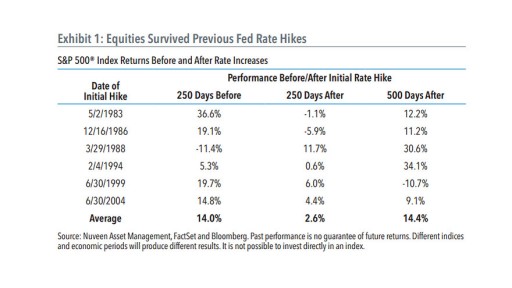

Nuveen Asset Management’s Robert Doll and Scott Tonneson are the latest to crunch the numbers. Going back to the early 1980s, they checked on the S&P 500 index’s SPX, -0.47% performance 250 trading days (roughly equal to a year) before and after an initial rate hike—as well as 500 days after.

“In most cases, equities performed well prior to Fed rate increases, then struggled or declined slightly after the onset of rate hikes, only to recover and outperform in the two years following the first rate increase,” they said in a note.

So how rough has it been in the aftermath of a hike? The analysts found the numbers were different in each of the six tightening episodes, but on average saw a peak-to-trough fall of around 10% in selloffs that tended to occur during broader uptrends.

Also read: Fed meeting should leave a Final Four of dates for rate hike.

Of course, the next rate-hike cycle, when it comes, will be different from those past cycles in one very important regard: Official interest rates for the first time in history are near zero and bond yields are also extremely low.

Doll and Tonneson argue that should give the Fed more room to deliver rate hikes without putting a drag on economic growth. After all, “if the Fed enacts for or five 25-basis-point rate increases over the coming year, the fed-funds rate would increase to just 1% to 1.25%. This would hardly be punitive by any measure,” they wrote.

They note that during the previous six rate-hike cycles, the fed-funds rate started out at an average of 5%.

Meanwhile, history shows that low and upward moving rates can be a positive backdrop for equities, they said.

So what are the other investment implications?

Doll and Tonneson expect equities to outperform other asset classes, in keeping with past cycles. Also, large caps have tended to outperform small caps while global equities have outperformed U.S. stocks (see chart below).

The strategists also look at sector performance. They note that sector returns tend to be volatile over time, but found some consistent trends (see chart below). They note that during periods of rising rates, valuations for equities don’t usually expand, which means earnings growth has to drive equity returns.

So it is no surprise that sectors that tend to have better growth prospects have tended to perform best as rates rise, they said—a factor that leaves them feeling positive toward technology and health care.

The past isn’t a perfect guide. Doll and Tonneson argue that some historic trends are unlikely to occur this time around. While energy has tended to perform well during hiking cycles, the recent collapse in oil prices and weakening demand from China is likely to keep a lid on the sector, they said. Utilities also appear vulnerable given “stretched” valuations, they said.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.