- Home

- >

- Commodities Daily Forecasts

- >

- Saudi Arabia Tells OPEC It Cut Oil Output by Most in 8 Years

Saudi Arabia Tells OPEC It Cut Oil Output by Most in 8 Years

Saudi Arabia told OPEC that it cut oil production by the most in more than eight years, going beyond its obligations under a deal to balance world markets.

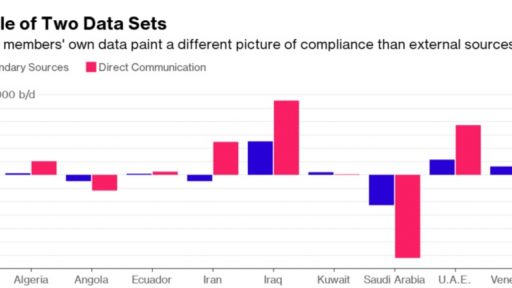

The kingdom reported that it reduced output by 717,600 barrels a day last month to 9.748 million a day, according to a monthly report from the Organization of Petroleum Exporting Countries. The group’s own analysts, who compile data from external sources, estimated that Saudi Arabia made a smaller

496,000 barrel-a-day cut -- in line with last year’s supply agreement.

“OPEC has done particularly well, they’ve surprised most analysts,” Spencer Welch, director of oil markets and downstream at IHS Markit, said in a Bloomberg radio interview before the report was published. “Saudi Arabia has made a particular effort to boost compliance.”

OPEC and Russia are leading a push by global producers to end a three-year oil surplus that sent prices crashing and battered their economies. While prices initially rallied 20 percent in the weeks after OPEC’s Nov. 30 agreement, the gains have since faltered on concern that rebounding U.S. output will fill the gap left by OPEC’s cuts.

Saudi Arabia’s data indicate it’s pumping about 310,000 barrels a day below its specified target. Saudi Arabian Energy Minister Khalid Al-Falih had said on Dec. 10 that the kingdom was willing to cut even more than was required to demonstrate its commitment to the accord.

In the same monthly report, Iraq, Venezuela and Iran told the organization they pumped more than allowed by the accord.

The negotiations leading to OPEC’s agreement in November were marked by a dispute over which production data to use. The group’s so-called “secondary sources” numbers -- derived from six external estimates -- form the baseline for the accord, even though Iraq had argued that the figures weren’t accurate and initially insisted that only statistics supplied by member governments should be used.

Iraq’s own data show that it’s exceeding its target by about 279,000 barrels a day, Venezuela’s show a surplus of

278,000 and Iran’s of 123,000 a day, according to the report.

OPEC secondary sources estimates indicate a far higher degree of compliance, with the 11 countries subject to the accord complying by more than 90 percent. The group’s output fell by 890,200 barrels a day from a month earlier to 32.139 million in January, the data show.

OPEC agreed in November to reduce production to 32.5 million barrels a day, although that total included about

750,000 barrels a day from Indonesia, which has since suspended its membership.

The 11 non-OPEC producers such as Russia, Kazakhstan and Oman who agreed to join in with output cuts haven’t complied as much, implementing a bit more than 50 percent of their pledged reduction, Kuwaiti Oil Minister Essam Al-Marzooq said Monday in Kuwait City. Kuwait, which chairs the committee that oversees compliance, is urging those countries to fulfill their commitments, he said.

“At the time when producers signed the deal, the initial commitments were to gradually increase cuts until April and May, so we were expecting to see some producers not fulfilling the

100 percent cuts,” Al-Marzooq said. “We understand the circumstances, and in February we are talking to non-OPEC producers to raise their cuts according to their commitments.”

OPEC’s January output still isn’t low enough to bring the oil market back into balance, let alone clear an inventory surplus the group estimates at about 300 million barrels, data from the report indicate.

If the organization keeps output at January levels, that would be about 800,000 a day more than it expects the market to require in the first six months of the year -- adding about 140 million barrels to world stockpiles.

The re-balancing process may be assisted by stronger-than- expected demand, OPEC said. The organization boosted its estimates for growth in world fuel consumption in 2017 by 35,000 barrels a day to 1.19 million a day.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.