- Home

- >

- Economic indicators

- >

- It’s not too late to “Sell in May and go away”

It's not too late to “Sell in May and go away”

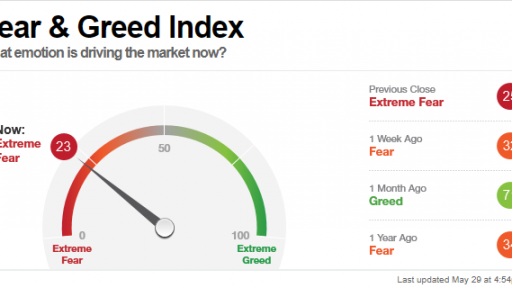

The old market adage to “Sell in May and go away” has merit. The U.S. stock market does tend to do far better between November and April than from May through October — a period when many of the biggest dives and swoons have occurred.

But market timing has its limitations, and being guided solely by an adage, even one based in reality, is unwise. As recent research indicates, there are ways to play the stock market between May and October that are less heavy-handed than selling everything in your portfolio and returning six months later to pick up where you left off.

In his InvesTech Research investment advisory letter, James Stack earlier this month acknowledged the wisdom of being out of the market for the six months starting May 1. Someone who invested $10,000 in a S&P 500 SPX, +0.60% index fund on May 1 every year beginning in 1960, assuming such a vehicle existed that far back, then sold the fund six months later at the end of October, would have turned the initial outlay into $29,273 by now, he calculated. In contrast, an investor in the same index fund who bought every November 1 and sold the following April 30 each year would have turned that $10,000 into $644,961.

What interests Stack more as the basis for an investment strategy is not what the over-all market does during different times of the year, but what various sectors do. Using a shorter study period, he observed that certain sectors excel during the winter months and give way to new leadership over the summer.

Between 1990 and the latest year, 2015 or 2016, three of the 10 sectors into which the S&P 500 is carved produced double-digit average returns each year between November and April. Consumer discretionary, which includes goods and services that people want but do not necessarily need, did best, with an average return of 11.0%. The corresponding figures for materials and industrials were, respectively, 10.9% and 10.2%.

But when summer arrives, it’s essentially all over for those sectors. During the May to October period, their average returns range from negative 1.2% for materials to gains of less than 1% for the others.

The two best sectors by far over the summer are health care and consumer staples, with respective average returns of 6.0% and 5.9% during the six months from May through October. Remember, this is the market’s weaker period generally, so in fact even the best summertime sectors fare much worse than the best winter sectors.

“The winter period favors cyclical and growth stocks, which are typically boosted by the holiday shopping season,” Stack wrote. “However, the market often takes on a defensive tone during the summer as these cyclical sectors move to the bottom of the list and the winter laggards take the lead.”

One other noteworthy sector is technology, which stays closer to the front of the pack throughout the year. It’s the only sector that beat the broad market during both halves of the year. Tech returned 8.9% on average from November through April, compared to 7.9% for the S&P 500, and 3.9% during the rest of the year, when the index produced an average return of 2.6%.

The discrepant sector performances suggest an approach for fine-tuning market timing based on the sell-in-May adage. Selling cyclical sectors in May makes sense, either by lightening up on any in your portfolio or by taking short positions in sector exchange-traded funds, such as Consumer Discretionary Select Sector SPDR XLY, +0.66% and its equivalents for materials, Materials Select Sector SPDR XLB, +0.72% and industrials, Industrial Select Sector SPDR XLI, +0.51% . At the same time, you could hold on to health-care and staples stocks or beef up exposure to them by buying ETFs such as Consumer Staples Select Sector SPDR XLP, -0.51% or Health Care Select Sector SPDR ETF XLV, +0.93%

With stocks expensive and in a trading range, and with an election coming between candidates that many Americans find bad and worse, in one order or the other, selling in May and staying away until November may not be such a bad idea in 2016. But if you want to be cautious and mindful of history in a way that adds a bit of finesse, this is a way to do it.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.