- Home

- >

- Stocks Daily Forecasts

- >

- Sell in May and go away? There’s a smarter play

Sell in May and go away? There’s a smarter play

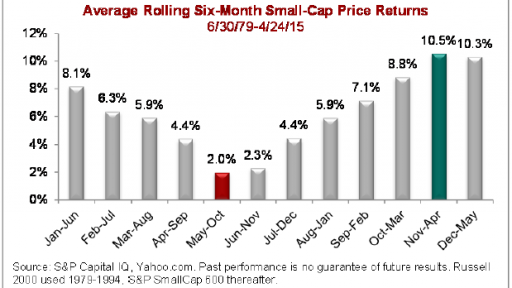

The old stock market adage recommends to “sell in May and go away,” but a review of historical data suggests that investors preparing to heed that advice and dump their holdings within a matter of days may be leaving money on the table.

In a new research note, Sam Stovall, the U.S. equity strategist at S&P Capital IQ, says that while the market has indeed shown some seasonal trends over time, there may be a wiser path than walking away from stocks altogether: “History shows (for it never guarantees) that an investor was better off rotating into defensive sectors of the market during this seasonally soft six month period than they were by either holding the broader benchmark or leaving the equity market altogether.”

Before you walk away from the market for six months, remember that the average gain of 2 percent is still better than what you can get by parking your portfolio in cash — and that some sectors, like Consumer Staples, Health Care and Utilities, have done much better than the overall index. “It’s not that people prefer to get hip replacements in the summer, but Health Care and Consumer Staples likely do better during challenging times for the overall market, since investors would rather embrace more defensive sectors than bail out of stocks all together,” Stovall вритес

Since 1995, investors who rotated into the Consumer Staples and Health Care sectors from May through October would have boosted their compounded returns by better than 3 percentage points a year. As the chart below suggests, though, those gains could get wiped out if investors fail to rotate back into the broader market.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.