- Home

- >

- Stocks Daily Forecasts

- >

- “Sell in May” this year, may not be a good idea

"Sell in May" this year, may not be a good idea

Instead of talk about stocks bottoming, there's more chatter recently about new highs, as small caps flirt with their former highs and money is jumping in to tech after this spring's washout.

"I think the incremental positive is we broke the string of lower highs that's been in place since January. Our take is the correction that began in January is coming to an end," said Ari Wald, technical analyst with Oppenheimer.

A number of analysts say ignoring the "sell in May" phenomena this year should be a good thing.

"I think you're seeing leadership reassert. Twenty-five percent of the market cap — tech — is now doing better. The fact we've seen small-cap outperformance is reflective of a market that does seemingly want to take on some risk," said Keith Parker, chief U.S. equity strategist with UBS.

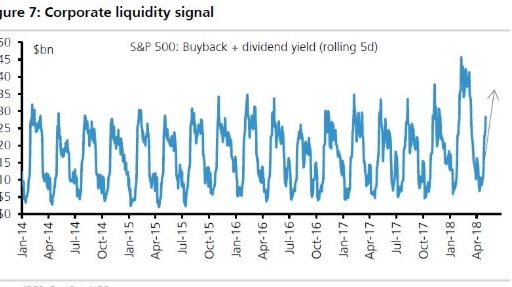

Parker also said the market stands to gain going into the summer simply on the sheer power of corporate buybacks. Buyback announcements are up 80 percent this year, and the actual buybacks are up about 50 percent, according to UBS. Corporations should be buying stock back for the next few weeks until the quiet period ahead of earnings in June, he said.

The market is not without risks, and those things that have been worrying it — trade wars, higher interest rates, geopolitical tensions — have not gone away. Oil prices could become a brake on market gains at some point, but so far stocks have taken a near four-year high in oil prices in stride. But if Middle East tensions set off an oil price spike, that would be a worry for stocks.

Analysts say the fears about trade wars, however, seem to be fading, in part because it appears there will be a new NAFTA agreement.

Also, President Donald Trump appears to have eased his stance toward China, after his weekend tweet on ZTE, and there are now signs the two countries are moving toward a deal that could give the company a reprieve from U.S. sanctions.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.