- Home

- >

- Daily Accents

- >

- Sell-off continues, bonds rise and more

Sell-off continues, bonds rise and more

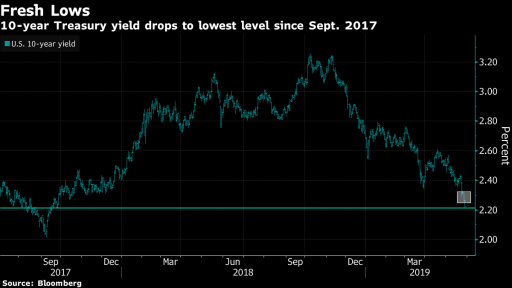

US stocks are on track to record a 12-week low, while bonds continue their rally, which further exacerbates the yield curve, reaching the level most recently seen in 2007. The worry comes from the fact that the bond market is beginning to give signals a recession that outweighs the tensions surrounding the war that seem to have diminished in recent days.

The S & P500 went through 2800 and started to target the technical levels, looking for key support. The sale was boosted after the Chinese media reported that the government could stop the export of rare metals and minerals used in the energy and defensive sectors. This opens a new front in the trade war between the two super powers.

Money supply to the bond market has also grown considerably, with the gap between three-month and ten-year bonds rising. The curve reached -13 basis points, most recently in 2007. Bond yields in Japan reached their lowest level in 2016, in New Zealand they recorded a record, and in Australia they even went below the base interest rate. The US dollar continues to climb for the fourth consecutive day.

Investors are beginning to watch more closely the signals from the bond market, doubting that the global situation will improve, and that the war will be resolved soon. Investors are starting to expect only extra escalation and new tariffs. This is most likely to come as a response to China's decision to stop the export of rare metals to the United States.

The Dow Jones Average is about to cut the day by 1%, the euro is now down 0.1%, pounds by 0.05% and the yen progressing by about 0.1%. Crude oil fell by 3.2% and gold gained 0.3%.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.