- Home

- >

- Stocks Daily Forecasts

- >

- Sell Off will stop after the solution of these 10 problems

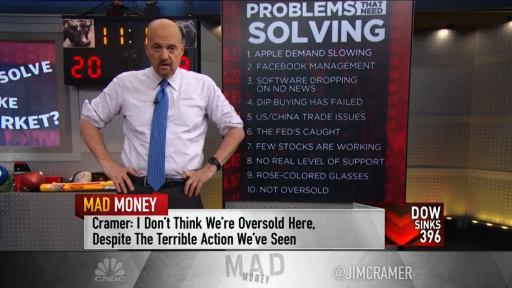

Sell Off will stop after the solution of these 10 problems

In order to return the good days of the stock exchange and erase the drop from Monday, there must be at least 10 things that are directly related to the technology companies. Here's what they say, according to Jim Cramer:

1. Apple - Rumors about Apple's alleged sales delays stemming from the Wall Street Journal report become too "repetitive", and many investors treat them as crippling revelations.

"This market can not stabilize until Apple stabilizes," said Cramer, whose charity has Apple shares.

2. Facebook - Following previous comments that Facebook shares will rise if CEO Sheryl Sandberg leaves the company, Cramer added that leadership has turned the social networking situation into an "unprecedented catastrophe."

3. The tech sector- The tech sector felt that the decline in the software sector was based on "nothing but the feeling that the global economy is slowing down quickly." Its weakness reminded of the end of 2016, when Salesforce.com's shares fell from $81 to $54: on "almost nothing."

"The incredible thing is that there is no concrete evidence that everything is really wrong, no one has seen a real backlog in the net," he said. "How do you end?" These brutal downturns in the technology sector usually end when sales are over and ratings can be assessed. " - says Cramer.

4. Buy The Dip - For the first time since the financial crisis, Buy The Dip strategy seems to not work.

5. China - Following US Vice President Mike Pens at the summit in Asia and the Pacific region on Saturday, Cramer is worried that Washington's tough stance against China may send markets down indefinitely.

"If this administration thinks that trade with the People's Republic simply provides fuel for their attempts to become a superpower, you could easily imagine that they are interrupting this trade entirely," he said. "Of course, this would be terrible for all kinds of American businesses - and that could not have happened - but many people believe it is quite possible.

6. FED - Bound between weaker housing data and strong employment results, the Fed is the sixth puzzle in the market, Cramer said.

"It's a shame to wait until things get so bad before the Fed changes its course ... but they do not seem to be interested in anything the markets are talking about," he said. "The Federal Reserve wants concrete evidence that people will be thrown out of work before they get less hawks, and I do not think that's the way to manage the Fed.

7. Confusion - The few stocks that weaken the downturn in the wider market are those that investors are willing to buy when worried about the recession.

"Given that no one thinks you can get into a recession so quickly after so strong economic numbers, there is real confusion, the confusion makes people sell," Cramer said.

8. Technical Analysis - Even on a technical basis, things seem ugly for the shares, the Mad Money host warned. The market will be hard pressed to find bottom of key levels of support.

9. Retail Sales - Those who believe that the economy is so strong that it can cope with some number of interest increases are themselves mistaken, Cramer said.

"When you look at all those very good retailers who have been taken out of the basket of big investor investors, you have to think about whether things are okay." Macy's, Home Depot, and Walmart are out of bullish trend!

10 - Sell Off is not over - We are not yet in a resale market area, which may mean that the worst is yet to come.

Photo: Mad Money Video

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.