- Home

- >

- FX Daily Forecasts

- >

- Sell the TRY and buy dollars

Sell the TRY and buy dollars

The economy is at a stage of rising inflation and zero interest returns in TRY, and households and companies have exchanged about $ 18 billion of local currency for dollars and euros since September 2018, according to Bloomberg.

These actions raise the share of foreign currency held by Turkish citizens to 47% of total deposits - the highest level for the past 13 years. This is a clear signal that the dollarization of the economy - a hedge against a depreciation of the pound and stubborn inflation - which has been gaining momentum since 2011, is not nearing its end, on the contrary, despite the attempts by the central bank to hold Turkish lira levels.

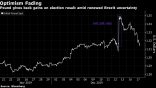

The country's central bank raised rates aggressively in September to halt the fall of the pound, which in turn triggered an impressive increase, with the currency recovering nearly a third of its value against the dollar from the bottom in the summer of 2018. But with the average short- , which pays savers less than one percent above inflation, local residents are starting to lose hope.

"It's definitely something that bothers me," said Timothy Ash, a currency strategist at BlueBay Asset Management in London. Low interest rates on deposits raise concerns about inflation and skepticism about "anti-market" measures such as price controls the government has taken - all this is demand for dollars.

While the Central Bank is very careful in telegraping its intention to maintain a tight monetary policy stance until it sees a more convincing fall in inflation, the government is leaning on lenders by forcing them to keep interest rates ahead of the municipal elections in March.

Parallel to the lack of credit demand and sluggish competition for bank deposits, the average interest rate on the pound deposit account dropped by more than 600 basis points from the peak in September to 21.1 percent. Total January inflation was 20.35%.

While inflation has cooled off the 15-year high of 25.2% in October, there is a growing concern that some of the government's moves to tackle the problem are only temporary solutions designed to soften numbers instead of coping with the primary reason. This adds to the list of reasons why the Turks eject their currency.

Source: Bloomberg Finance L.P.

Charts: Used with permission from Bloomberg Finance L.P.

Original Post: Turks Are Dumping Liras and Hoarding Dollars

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.