- Home

- >

- Trading University

- >

- Short-term strategy with RSI and ATR

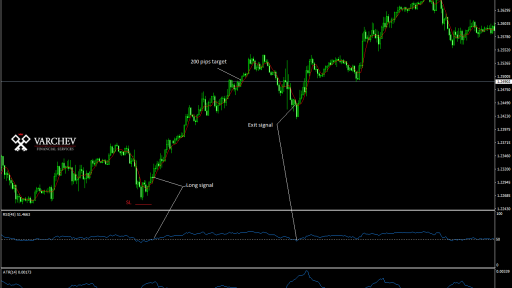

Short-term strategy with RSI and ATR

This strategy is suitable trading day of each currency pair and uses two indicators for inputs.

Parameters and indicators:

Time frame: 30 minutes chart

5 periods SMA

45 period RSI

21 period ATR (Average True Range)

How to trade.

Signal debt position of the strategy we have when the price crosses the first moving average upwards and off 5 pips above it and RSI is above 50.

We enter a short position when the price crosses the first moving average distance of 5 pips and RSI shows that it is under 50. This strategy is better to use in currency pairs that are characterized by longer-lasting trends.

Stop Loss order is usually placed 50 pips away from the entry price.

Target of this type of trade is usually from 150 to 200 pips in the trend currency pairs like GBP / JPY, EUR / JPY and USD / JPY. Output can also take and return signal.

ATR was used to determine the volume of transaction in order to observe proper Money Management.

How does ATR?

Average true range measured volatility within a given period. Reaches high values strong volatility and decline in volatility - declined to minimum values. Traders mostly use ATR for further analysis tool based on current levels of volatility relative to historical average volatility registered. For example, if we ATR = 0,0015 we will know that the average candle for the selected period is 15 points. So we will consider that you have to put a stop to no less than 15 points because the stop likely to be hit by noise is very high within the ATR range while off sharply decline.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.