- Home

- >

- Daily Accents

- >

- Should we expect surprises from the FED in 2019?

Should we expect surprises from the FED in 2019?

How long will the Fed's patience continue? What tolerances have they assigned to interest rates compared to the economic performance of the economy? What does this mean for their future policy?

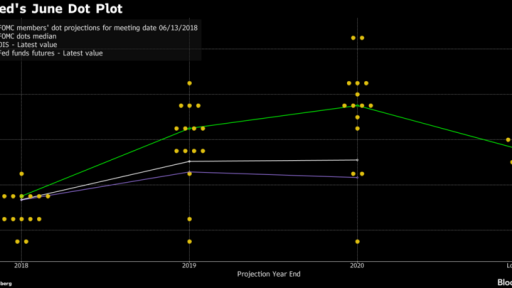

The fact is undisputed. The US economy is stable and the FED hit the brakes on time. Whether under Trump pressure or by real judgment, the dot plan they had up to now is no longer up to date. What does the future mean? We can not guess, but if we rely on the facts as an argument, it is clear that the Federal Reserve will refrain from a future interest rate move, at least for this year. Why? Because they may have realized that tightening monetary policy, along with systemic risks around the globe and inflating the corporate debt bubble and expectations for a weak reporting season, would also lead to a serious risk of "hindering" US economic growth. In order to prevent this happening, the FED decided to remain in a standstill position. See how the economy will develop with current interest rates. Meanwhile, the outcome of the trade negotiations will also be monitored.

Last December, the forecast was for two interest rises this year. Given the new circumstances, there are no expectations.

"Waiting Policy" is a wise move that undoubtedly calms the markets and the morals of the US President. But let's not relate Powell's economic decisions to the political scene. And why is it bad to politicize central banks, you can find out here.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.