- Home

- >

- Daily Accents

- >

- S&P 500 could pally 15% if it stays above this level

S&P 500 could pally 15% if it stays above this level

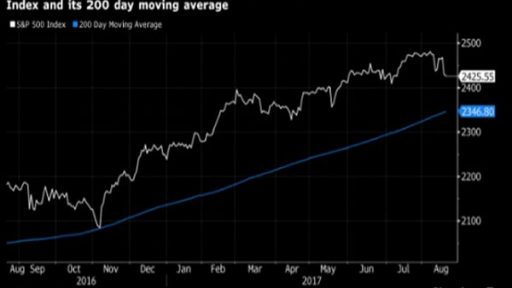

Despite having one of the biggest drops of the year last week on trouble in the White House, U.S. stocks are still holding above a key technical level known as the 200-day moving average. Analysts at Bank of America Corp. say that if the S&P 500 Index can stay above this level, we could close out the year 15 percent higher than Friday’s close.

Analyst Stephen Suttmeier laid out three scenarios for the index for the rest of the year. One of them involves the index staying above the 200-day moving average for the rest of 2017, and possibly ending the year at 2,800 or even higher. The gauge last touched the average in November of last year.

“The data suggest a dip to 2415-2400 and year-end upside to 2647-2690 and even 2800,” they wrote in a note late Friday.

“Following this scenario would suggest an acceleration of the secular bull trend that began on the April 2013 breakout to new highs on the S&P 500.” The other two scenarios laid out by the

firm also suggest dips, but less upside potential, rising to or just above 2,500 in both cases.

The index was little changed at 2,425 after the open on Monday and is up just over 8 percent this year, but below the highs reached earlier this month. Right now, the 200-day moving average is sitting around 2,350.

Source: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.