- Home

- >

- Opportunities for profit today

- >

- SP500 has reached the last level of support, should we expect a rebound?

SP500 has reached the last level of support, should we expect a rebound?

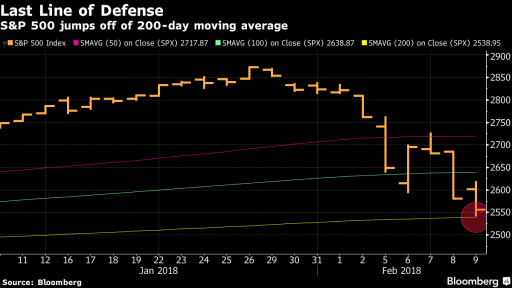

Just a week ago, the average of the average was an unthinkable level for a large number of investors, but today the index is testing the level again, with a strong rebound from the support zone in the last few minutes. The SP500 registers its worst week for almost seven years.

What does the second touch of the 200 periodicals show this week and is the level for long?

Looking at the details of a one-hour clock, we have a double billiard pin bar, then a strong pulse upward, which shows the determination of the bulls from the current levels. Given the strong foundation behind a large number of companies in the index and good global economic performance, the levels are good for long positions and at the moment the price gives us a good opportunity for positioning with a short stop. The RR ratio of current levels to the top will be 1:4.

SL: 2520

Alternative Scenario: If the price goes below 200 periods combined with horizontal support and stays in several consecutive bars there, the positive scenario will be spoiled and the likelihood of a subsequent collapse will increase.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.