- Home

- >

- Stocks Daily Forecasts

- >

- S&P500 last week’s scenario is likely to repeat

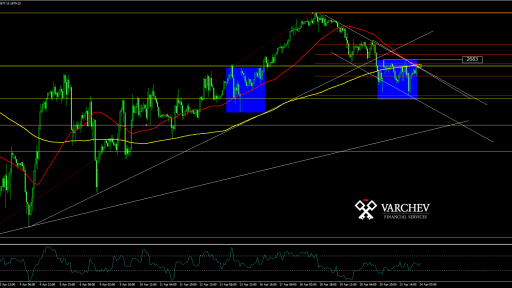

S&P500 last week's scenario is likely to repeat

Looking at the S & P500 on a one-hour (H1) chart, we see a clear pin bar on Friday evening at market closing in the last two weeks, followed by a gap toward north. If the dependence on price movement this week remains from the last one, we can expect an increase in the price of the indeces by the end of the week and massive profits taking on Friday.

A break above 2683 will create a prerequisite for a strong upward momentum, and the levels above the bottom 2657 will likely be backed up by a lot limited buy orders.

Alternatively a breakout below this level is likely to lead to a 2635 level test.

Cash flows at the S & P500 also support the likelihood of a positive scenario for the week ahead, with long positions at levels 2665-2670 being more rational with stops below the bottom at about 2645.

During the week, we expect ECB and BoJ meetings on interest rates, and perhaps the tone of the central bankers will not be aggressive about monetary policies, which would have a positive effect on stock markets.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.