- Home

- >

- Fundamental Analysis

- >

- S&P500: the market would be strong even without Trump’s tax reform

S&P500: the market would be strong even without Trump's tax reform

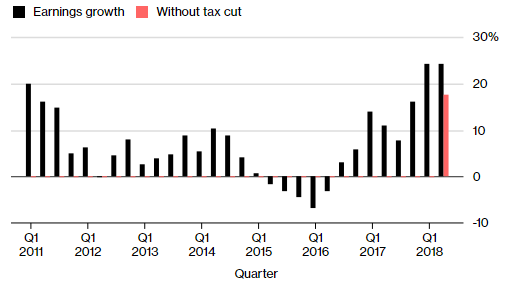

One of the driving fundamentals for the markets this year has been Trump's lowering of corporate taxes from 37% to 20%. Even without the fiscal stimulus from lower taxes, the earnings of companies in the S&P500 would have grown at a record pace.

The chart shows that even without the tax break, growth in earnings of S&P500 companies would be close to 20% (the red bar), the highest growth in earnings since 2011. The fundamentals are to a large extent supportive of the current record levels of the S&P500. An additional fiscal stimulus would be the planned infrastructure reform proposed by Donald Trump.

Technical picture

The divergence seen on the DeMarker oscillator has been violated by the index. The weakening of the trend that caused the divergence was most likely the result of the strong resistance around 2875 and around 2900. The violation of the divergence is supportive for the S&P500 index.

The present correction is better seen on the hourly chart of the S&P500.

The price is currently supported by the 50-period MA. The correction will likely continue until 2896-2897, which is the support of a previous low and the 50 SMA. From there we expect a continuation of the upwards trend.

S/L: 2893.67; the 2894 level has supported the price three times in the last two days. A violation of this support level would be a significant bearish signal.

Source: Bloomberg Finance L.P.

Chart: Use with permission of Bloomberg Finance L.P.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.