- Home

- >

- Stocks Daily Forecasts

- >

- SP500 Worst Monthly Outflow in 2009, What are the Prospects?

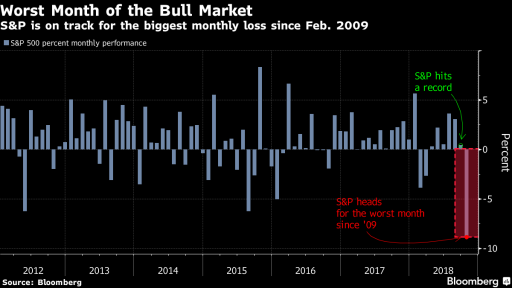

SP500 Worst Monthly Outflow in 2009, What are the Prospects?

Technology companies growth has managed to bring US benchmarks to positive territory, while US bonds rose and USD hit new high for the year. Nevertheless, the outlook for stock markets remains negative.

The strong earnings of Twitter, Microsoft and Tesla sent the SP500 on positive territory, but it is still too early to be optimistic. After the markets close at 23:00, we expect reports from Intel, Amazon and Alphabet. This in turn will lead to a strong volatility in indexes during the Aftermarket.

A dose of positivism will not be superfluous, as the SP500 is about to record the worst monthly decline since 2009. (the main chart). Investors, however, remain concerned about the reporting season, which we expect to see the first damage caused by the war.

Technical view on SP500 - D1

The technical picture does not look good, as the price has been able to stay long below the main support zone, formed by a major trendline of 2016, 50% Fibonacci correction of the last ascending wave and 200SMA. In view of this and the poor foundation of the war, I expect the bulls to be less ambitious, despite the good reports of some companies. Entry from the current levels, regardless Long or Short, is unsuccessful, and the more likely scenario remains, a bottom test formed in February and April.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.