- Home

- >

- FX Daily Forecasts

- >

- Stay away from GBP yet, Brexit risks still loom

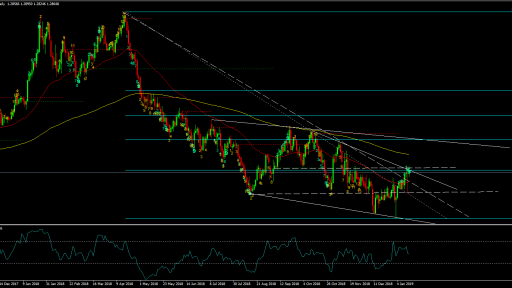

Stay away from GBP yet, Brexit risks still loom

The British pound has shown resilience following a crucial U.K. parliamentary vote, but several experts warned that the currency could come under pressure in the months ahead because uncertainties remain on how Britain would leave the European Union.

The pound dropped sharply against the U.S. dollar immediately after the British parliament on Tuesday voted to reject Prime Minister Theresa May's Brexit plan to leave the European Union. But the currency regained losses to rally against the greenback as traders cut back bets of a hard Brexit.

"We think there're still a lot of risks out there. Certainly the defeat of May's proposal yesterday takes away one leg of uncertainty but we still have many others," Patrick Bennett, a strategist at Canadian Imperial Bank of Commerce, told CNBC's "Street Signs" on Wednesday.

"If you were to look at the circumstances that we have now: A confidence vote that's coming up, potentially another referendum, potentially a general election — none of those things are going to endear you to the economy or to the currency at this level, so we think caution is still the best approach," he added.

Major wealth managers have also advised clients not to bet on or against the pound given those uncertainties. UBS, in a Tuesday report after the vote, said exposure to pound-denominated assets "should be maintained at benchmark levels until more clarity emerges."

"At this stage we do not advocate taking directional views on sterling and UK assets," wrote Dean Turner, economist at UBS Global Wealth Management.

David Bailin, global head of investments at Citi Private Bank, said before the Tuesday parliamentary vote that he had suggested to clients not to trade the pound.

It's difficult to map out a scenario that will most likely happen, he explained, and because of that, it's hard to form a view on whether the pound would rise or fall

.

Greater certainty to the Brexit situation would help the British currency find a more definite direction, Bennett said. That could mean the U.K. parliament coming to an agreement on the next step to take, or a clear majority of the British people showing support for any proposal, he added.

Until then, the pound would likely remain weak against most major currencies, Bennett said.

Source: SNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.